Deputy Prime Minister and Minister of Finance Delivers 2023 Fall Economic Statement

On Tuesday, Deputy Prime Minister and Minister of Finance Chrystia Freeland delivered the federal government’s 2023 Fall Economic Statement, outlining $15 billion in loans to encourage the development of new rental and affordable housing and apartments. The announcement also provides timelines for the delivery of Investment Tax Credits (ITCs) in support of clean electricity and energy.

The 2023 Fall Economic Statement provides Canada’s minister of finance the opportunity to describe the major economic developments since her most recent budget, and to present a status report on the national economy, providing information on the difference between earlier and current forecasts of economic growth as well as recent trends in government revenues and spending.

Setting the scene

In advance of today’s fall economic statement, deputy prime minister and minister of finance Chrystia Freeland said that it would focus on two key challenges:

… making life more affordable for Canadians and taking further concrete action on housing. We know this is an urgent priority for Canadians, and we believe that at the heart of this issue is supply, supply, supply.”

Also last week, three think tanks weighed in with reports that offered tight descriptions of the key factors limiting the minister’s room to manoeuvre in her update:

- University of Calgary economist Trevor Tombe noted that “Federal finances are under increasing strain from slowing economic growth, expanded affordability measures, new social programs (such as dental care), massive subsidies for battery plants, and, perhaps most important of all, rapidly rising interest rates.” The key number in his analysis is that interest on the national debt now costs Canada almost a billion dollars a week.

- A report from the University of Ottawa’s Institute of Fiscal Studies and Democracy revealed that high mortgage costs are now the biggest factor in the affordability challenge facing Canadians, and that “mortgage interest costs as a percentage of disposable income have entered modern unprecedented territory.”

- The Parliamentary Budget Officer estimated that the total cost of government support for EV battery manufacturing by Northvolt, Volkswagen and Stellantis-LGES to be $43.6 billion over 2022-23 to 2032-33 — $5.8 billion higher than the federal government’s announced costs of $37.7 billion.

Key numbers in today’s update

The national economy

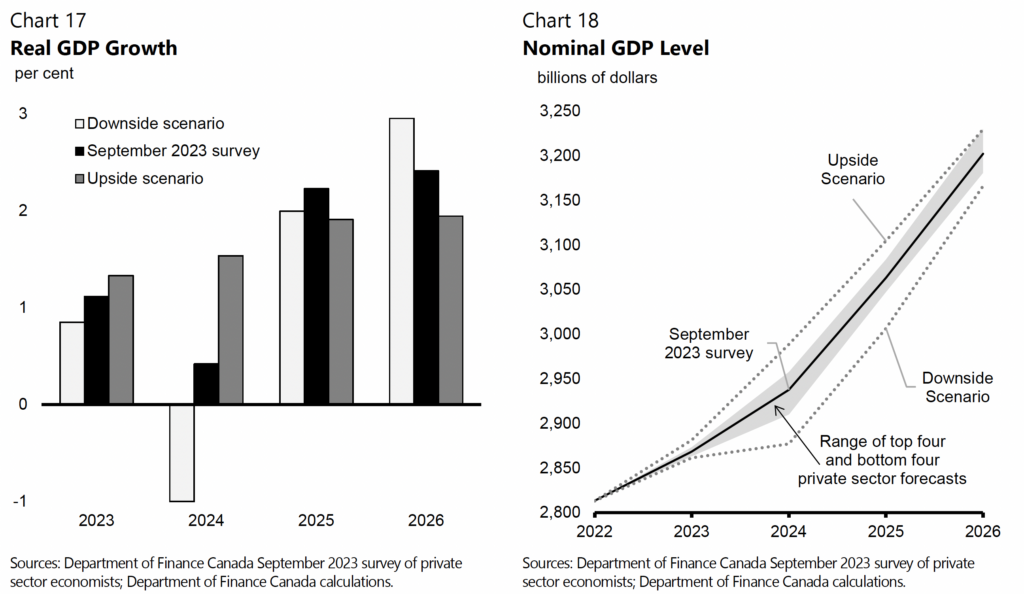

The private sector economists surveyed by Finance Canada expect real GDP growth to be 1.1 per cent in 2023—up from the 0.3 per cent projected in Budget 2023. Growth of 0.4 per cent is expected for 2024, compared to the 1.5 per cent projected in Budget 2023, with growth projected to rebound to 2.2 per cent in 2025.

Largely reflecting stronger economic growth, the level of nominal GDP in 2023 is expected. is expected to be $32 billion higher than Budget 2023 projections. However, this stronger growth is being tempered by elevated interest rates. With the economy expected to weaken over the next year, this nominal GDP difference with Budget 2023 narrows to zero in 2024 and is lower by $2 billion in 2025.

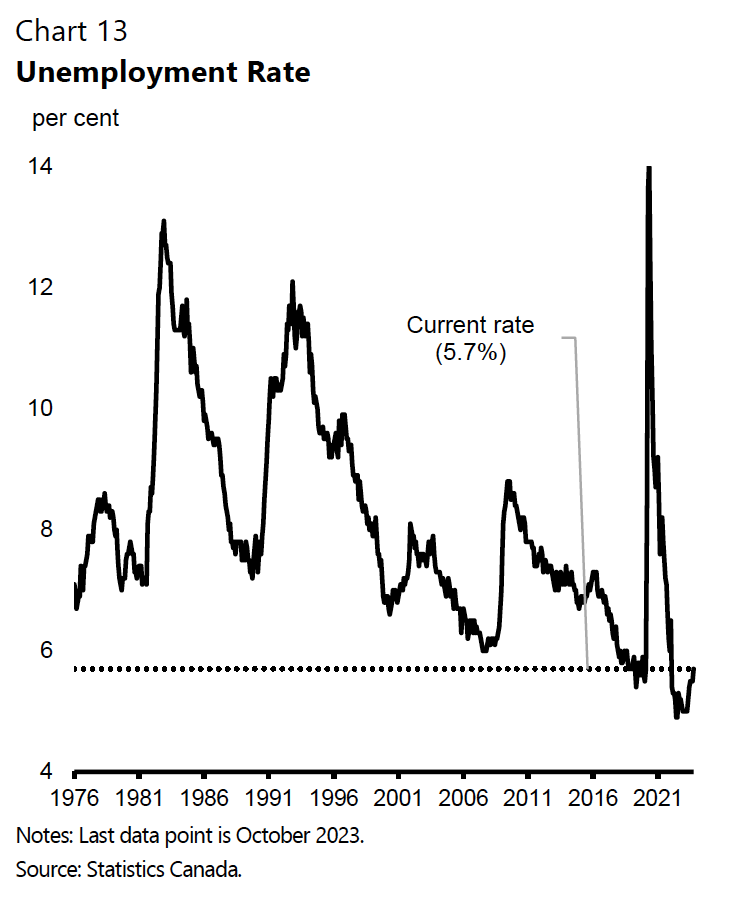

Employment

The unemployment rate is expected to rise to 6.5 per cent in the second quarter of next year, remaining historically low and far below the peaks experienced during recessions. The unemployment rate should ease to an average of 6.2 per cent in 2025.

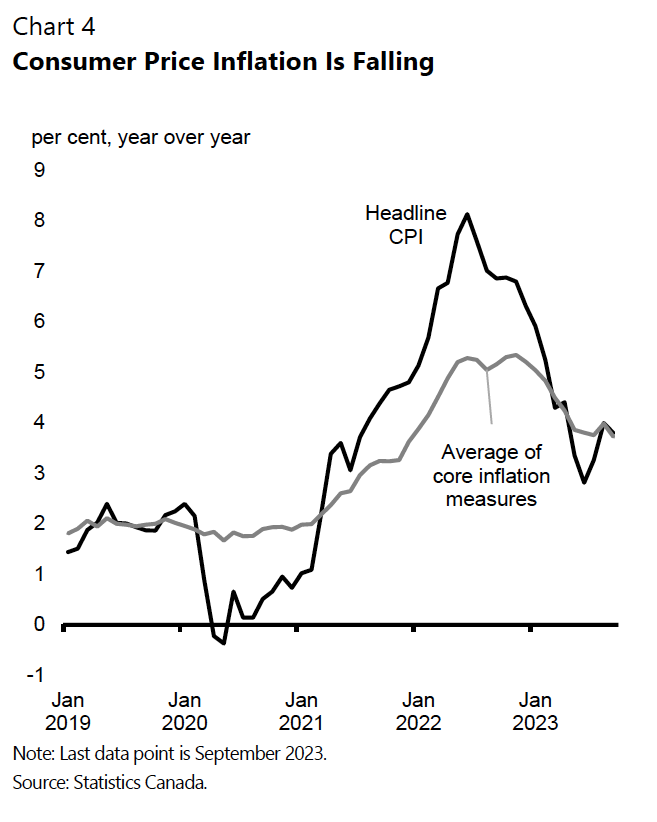

Inflation

Private sector economists expect CPI inflation to remain at or above 3 per cent through the first quarter of 2024, with an annual average of 3.8 per cent in 2023, consistent with higher global energy prices and recent data suggesting that underlying inflation remains persistent. Inflation is expected to fall below 3 per cent in the second quarter of 2024, reaching 2 per cent by the end of 2024, and averaging 2.5 per cent in 2024 and 2.1 per cent in 2025.

The growth forecasts

Largely reflecting stronger economic growth, the level of nominal GDP in 2023 is expected to be $32 billion higher than Budget 2023 projections.

The government’s fiscal situation

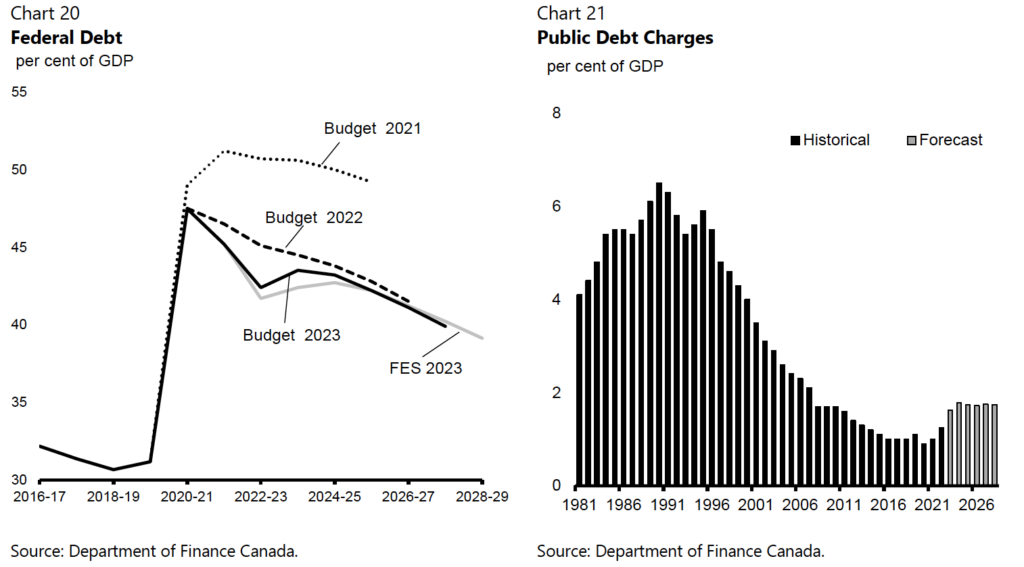

The government claims “the economic plan outlined in the 2023 Fall Economic Statement delivers on the government’s fiscal anchor, enabling Canada’s federal debt-to-GDP ratio to decline from 2024-25 onwards, reaching 39.1 per cent in 2028-29. In addition, public debt charges as a share of the economy are expected to remain near historically low levels”.

The deficit for this fiscal year is projected to be $40 billion — almost exactly what Minister Freeland forecast in the spring budget. But with interest rates at a 20-year high, the cost to support the debt has spiked from $20.3 billion in 2020-21 to $46.5 billion in this fiscal year. The debt service charges will march even higher still in the years ahead. Carrying the debt is expected to cost the federal treasury $60.7 billion a year in 2028-29, according to the economic statement.

Federal spending

The federal government proposes to spend about $20.8 billion more over the next six years than the earlier projected. The minister positioned the increase as smaller than in years’ past and a sign of fiscal prudence. Most of the new spending is earmarked for new housing initiatives, such as low-cost loans to builders.

Reduced spending numbers

The federal government promised in the spring budget to reduce overall government spending by $14.1 billion from 2023 to 2028, and by $4.1 billion annually after that. On November 9, Treasury Board President Anand released details for the first $500 million. Today’s Economic Statement announced that the government will extend and expand its Budget 2023 efforts to refocus government spending, with departments and agencies generating additional savings of $345.6 million in 2025-26, and $691 million ongoing. Combined with the $15.4 billion in refocused spending outlined in Budget 2023, the government will be saving $4.8 billion per year in 2026-27 and ongoing and returning the public service closer to its pre-pandemic growth track.

What’s next?

In order to implement the tax measures outlined in the Fall Economic Statement, the government will need to table new legislation in Parliament. As of Tuesday evening, a notice of Ways and Means motion has not been tabled and posted to the Order and Notice Paper of the House of Commons but is expected in the coming days. The Budget Implementation Act no. 2 is expected to be tabled at first reading in the House next Thursday.