A made-in-Canada plan: strong middle class, affordable economy, healthy future

In preparing Tuesday’s budget, Deputy Prime Minister and Minister of Finance Chrystia Freeland has faced a conflicting set of signals from the Canadian economy. The latest Consumer Price Index numbers show a 5.2 per cent rise in inflation year over year in February, the largest deceleration in its growth since April 2020. Meanwhile, grocery prices are still increasing rapidly, up 10.6 per cent compared with a year ago and the seventh consecutive month of double-digit increases, which continues to raise the cost of living for millions of Canadians.

The Bank of Canada expects inflation to fall to about 3 per cent by the middle of 2023 but is projecting near-zero growth in the same period. Bank governor Tiff Macklem has said that Canada could experience a “mild recession” in the coming months, a view that is shared by many Bay Street forecasters. While GDP growth stalled in the fourth quarter of 2022, the labour market continues to defy expectations, adding 150,000 new jobs in January. On the other hand, the Canadian dollar has dropped by three per cent against the US dollar since the beginning of February, meaning higher costs for imports that will add to inflation.

Amid these uncertainties, economic analysts were watching Tuesday’s budget closely for the economic assumptions used by Finance Canada, its forecasts for economic growth and federal tax revenues, and the trajectory towards budget balance.

Spending vs restraint

In prepositioning Budget 2023, Minister Freeland identified three major spending priorities and one somewhat conflicting objective – the need to “exercise fiscal restraint.” In a pre-budget event last week, the minister promised “narrowly focused” help for low-income Canadians facing the rising cost of living, funding of the recent health care deal reached with the provinces, and to “invest aggressively” in clean technology. The latter is needed for Canadian industry to compete with the billions of dollars in subsidies and tax breaks contained in the US Inflation Reduction Act which aims at reducing carbon emissions.

Making all these new “investments” while not fuelling inflation and pushing a balanced budget further into the future are the challenges that lie at the heart of Budget 2023.

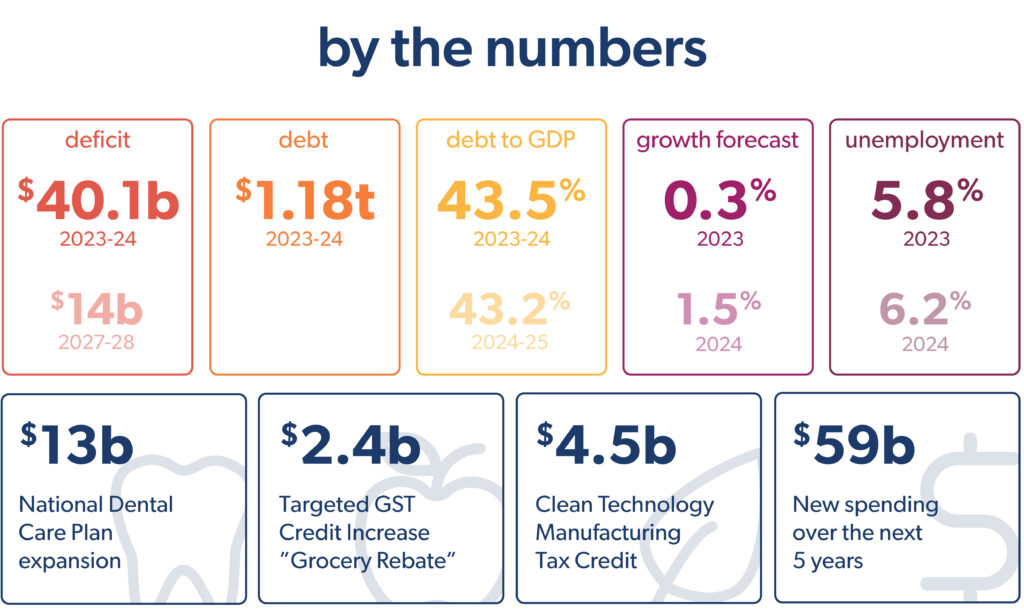

The Parliamentary Budget Officer recently warned the estimates made in last fall’s economic update of $69.4 billion in cumulative deficits from the coming fiscal year through to fiscal 2028 have nearly doubled to $112.7 billion since November. And that is before the new spending tabled in Tuesday’s budget.

As a down payment on restraint, Tuesday’s budget announced cuts to federal travel and reduced outsourcing that are estimated will save roughly $7 billion over five years. In addition, the budget served notice that a 3 per cent reduction of eligible spending by departments and agencies will be phased in by 2026-27. This is anticipated to lower government spending by $7 billion over four years, starting in 2024-25.

Analysis

Minister Freeland had signalled internally Budget 2023 was to be a signature document moving out of COVID-19 and its large-scale spending to a more prudent and restrained fiscal strategy with a centrepiece around investing in greening the Canadian economy in a broad and determined way. The minister was clear she didn’t want government spending to fuel inflation. The new path was to be set before Budget 2024 when pre-election politics would likely open the spending taps once again.

Events and pressures ultimately forced compromises in the spending structure of the 2023 budget and its consequent fiscal impact. The minister’s public preconditioning kept evolving week by week to keep up with the changes.

The crumbling health care system led to the winter decision to substantially increase federal health transfers. The war in Ukraine war meant a year of financial contributions to that country and its defence. The U.S. Inflation Reduction Act created an imperative to invest in clean technology at significant fiscal levels (although the minister was inclined to do that anyway,) and the political imperatives of minority government dictated both the second instalment of the dental care program and the extended GST rebate program to meet cost of living pressures (styled as a “grocery rebate” although recipients can spend it as they like).

The sheer size of the combined health and dental packages dwarfed the clean tech and energy package, making this budget more a social policy document than a green economic development effort.

When all is said and done, the minister could not hold the line on important metrics of government spending and the overall federal fiscal position.

The deficit is higher than projected in the fall and above the one per cent of GDP that had been an informal yardstick of acceptability (although it is still well within what most economists agree is sustainable.) Perhaps more tellingly, although they decline, the deficits continue over the five-year horizon and the promise of a balanced budget within that time frame has disappeared.

The debt-to-GDP ratio, still the government’s fiscal anchor, will rise for the first two years, reversing a projected decline. It ends up just shy of 40 per cent five years from now – the aspirational 30 per cent no longer anywhere in sight. Debt service will double to $50 billion.

And the government spending to GDP percentage is up for all five years from the projections in the fall.

All those outcomes may in fact be worse if overall economic conditions deteriorate (as the budget says they might.) Importantly, the government also eliminated its normal contingency reserve, increasing the vulnerability of the fiscal framework to economic shocks.

To be fair, Minister Freeland has been unusually tough on departmental budget asks leading up to this budget, but rejected spending does not show up on budgetary tables or talking points.

Interestingly, the final numbers could have been worse absent some new tax measures and decisions to actually cut back on some spending.

On the revenue side, while still modestly healthy, the positive bumps last year generated by inflation’s impact on nominal GDP have diminished significantly and will disappear next year, putting pressure on the fiscal framework.

The budget introduced tax increases to offset some of that. Minimum tax increases paid by the wealthy and changes in dividend treatment for banks will generate significant revenue over five years. But most of the mitigating measures involved cuts, reallocation, and lapsing voted but unspent funds.

The budget cut spending on government travel and consultants by $7 billion over five years. History has shown those are tough to monitor and enforce but it does show some intent in the absence of any visible progress in the Program Review promised in Budget 2022 which is to start generating savings next year but appears stalled internally. Those savings ($6 billion) have already been booked in the fiscal framework and should they fail to materialize, deficit levels will rise.

The budget introduced two measures that seem designed to substitute for or supplement that review. First, it cut departmental eligible spending across the board by three per cent. Second, it snatched away thus far unallocated spending in many of those departments and agencies. The savings combined to about $12 billion over five years.

All of this has played out against the uncertainties of interest rate increases leading to a recession of unpredictable depth, only slowly diminishing inflation (with stubbornly high food inflation) and banking concerns in the U.S., Switzerland and Germany. Once again, the budget had to produce alternative scenarios to account for the uncertainties.

Looking forward, private sector economists forecast a shallow recession in their projections to Finance. Finance provided two forward scenarios: an optimistic one which projected a bare escape from recession and a pessimistic one that projected significant downside risks leading to a deeper, longer recession with unemployment rising above six per cent.

And ironically perhaps, there is still a large fiscal pressure looming as the government negotiates with the Public Service Alliance of Canada – the largest government union – which is demanding inflation catch up wages and moving into a strike position in the Spring.

In the final analysis, the “news” focus of this budget is likely to be on the rising deficit and debt to GDP metrics driven by significantly increased government spending.

This budget may not be the full page turn in narrative the minister was hoping for.

Major new initiatives

Targeted inflation support

The new “Grocery Rebate” delivered through the GST credit, with costs of $2.5 billion to help 11 million households. It will provide up to $467, single individuals up to $234 and elderly people up to $225 on average, delivered through a one-time payment from the GST tax credit, as soon as the legislation is passed.

Health care transfers

The budget provides $46.2 billion in new multi-year money for increased transfers to provinces and territories for health care, as announced in early February. In addition, the budget proposes to provide a total of $359.2 million over five years, starting in 2023-24, to support a renewed Canadian Drugs and Substances Strategy, and $158.4 million to support the new 988 Suicide Prevention Line which takes effect this coming November.

The Canada Dental Benefit

Tuesday’s budget confirmed the second stage of dental care will go ahead this fiscal year, a key feature of the Liberal-NDP Confidence and Supply Agreement, funded by $13 billion over five years. It will extend coverage from children under the age of 12, to those under 18-years-old, seniors, and persons living with a disability, with full implementation by 2025. The program is restricted to families with an income of less than $90,000 annually, with no co-pays for those under $70,000 annually in income. The expansion of the dental program announced in the budget will save families on average $1,247 per year.

In addition, the federal government will spend $250 million over three years to establish a new Oral Health Access Fund to expand access to dental care through investment in targeted measures to address oral health gaps among vulnerable populations to reduce barriers to accessing care, including in rural and remote areas.

Net Zero Transformation and countering the Inflation Reduction Act

The federal government has made net zero investments a consistent feature of its budgets since 2016. The carbon pricing and rebate system introduced in 2019 is the centerpiece of Canada’s plan to reduce its greenhouse gas emissions. The government sought ways for Canada to compete internationally for capital investment to build a “clean” economy. Previous spending has moved Canada toward that objective, in particular the 2022 budget and the accompanying Emissions Reduction Plan, that included a long list of measures, additional spending and new government agencies intended to unlock private capital, such as the $15 billion Canada Growth Fund.

But as is typical of ambitious goals, more needs to be done, and done quickly. Clean tech observers have noted that dozens of industrial decarbonization projects need to be built to reach Canada’s 2030 target, and to be operational by 2030, many of these projects will require final investment decisions within the next 24 months. Global investors will, in the near term, be weighing the economic incentives available in Canada against those in other jurisdictions, particularly the United States.

The government has been signaling since late summer 2022 that the United States’ industrial policy to attract investment and create jobs in America, via incentives in the 2022 “Inflation Reduction Act” (IRA) are impossible for Canada to counter on a dollar-to-dollar basis. The government has been considering how Budget 2023 could counter those inducements and the other advantageous factors in the United States, such as regulatory and permitting “nimbleness” and a lower cost workforce. Minister Freeland recently stated, “Canada will either capitalize on this historic moment, on this historic opportunity before us, or we will be left behind as the world’s democracies build the clean economy of the 21st century.” Tuesday’s budget presents an extensive plan to respond to the Inflation Reduction Act through targeted investment tax credits (ITCs):

- The Clean Electricity Investment Tax Credit – Canada will need to at least double generation capacity and will need to build new transmission and distribution lines to meet electrification demands of EV and home heating. Budget 2023 enables both new projects and the refurbishment of existing facilities with this tax credit. As well, both taxable and non-taxable entities such as Crown corporations and publicly owned utilities, and corporations owned by Indigenous communities, and pension funds, would be eligible for the tax credit. The tax credit will provide a 15 per cent refundable tax credit for eligible investments in:

- Non-emitting electricity generation systems: wind, concentrated solar, solar photovoltaic, hydro (including large-scale), wave, tidal, nuclear (including large-scale and small modular reactors);

- Abated natural gas-fired electricity generation (which would be subject to an emissions intensity threshold compatible with a net-zero grid by 2035);

- Stationary electricity storage systems that do not use fossil fuels in operation, such as batteries, pumped hydroelectric storage, and compressed air storage; and,

- Equipment for the transmission of electricity between provinces and territories.

- Note: to receive the full 15 per cent tax credit certain labour requirements must be met (e.g. wages paid are at the prevailing level, and that apprenticeship training opportunities are being created) will need to be met or the credit rate will be reduced by ten percentage points. The NDP claim these labour requirements were included due to their efforts, and that due to their efforts Labour is represented on the Board of the Canada growth fund.

- The Canada Infrastructure Bank will invest at least $20 billion to support the building of major clean electricity and clean growth infrastructure projects. These investments will be sourced from existing resources.

- The Government will provide $3 billion over 13 years to Natural Resources Canada to recapitalize programs that support critical regional priorities, Indigenous-led projects, electricity grid innovation, and Canada’s offshore wind potential.

- The Investment Tax Credit for Clean Technology Manufacturing – Budget 2023 provides a refundable tax credit equal to 30 per cent of the cost of investments in new machinery and equipment used to manufacture or process key clean technologies, and extract, process, or recycle key critical minerals, including:

- Extraction, processing, or recycling of critical minerals essential for clean technology supply chains, specifically: lithium, cobalt, nickel, graphite, copper, and rare earth elements;

- Manufacturing of renewable or nuclear energy equipment;

- Processing or recycling of nuclear fuels and heavy water;

- Manufacturing of grid-scale electrical energy storage equipment;

- Manufacturing of zero-emission vehicles; and,

- Manufacturing or processing of certain upstream components and materials for the above activities, such as cathode materials and batteries used in electric vehicles.

- Note: Augmenting this tax credit is an extension of the Reduced Tax Rates for Zero-Emission Technology Manufacturers by three years, to 2034-2035.

- The Investment Tax Credit for Clean Hydrogen – This tax credit will provide varying levels of between 15 and 40 per cent of eligible project costs, with the projects that produce the cleanest hydrogen receiving the highest levels of support. The Clean Hydrogen Investment Tax Credit will also extend a 15 per cent tax credit to equipment needed to convert hydrogen into ammonia, for transportation. The tax credit will only be available to the extent the ammonia production is associated with the production of clean hydrogen. As with the Clean Electricity Tax Credit labour requirements will need to be met to receive the maximum tax credit rates.

- Budget 2023 announced that the Government will begin a consultation on a broad-based approach to using Contracts for Difference (CFD), which will augment the use of this tool by the Canada Growth Fund. CFD intends to spur private investment into decarbonization by guaranteeing a minimum price for the emissions credits earned by reducing GHG emissions. If the credits’ value ends up higher than the minimum amount the company pays back the difference to government.

- To support clean electricity investment in Canada, Budget 2023 proposes to introduce a 15 per cent refundable tax credit for eligible investments from public utilities and industry in zero-emission electricity generation systems such as wind, solar, large and small-scale hydro, wave, tidal, and large-scale and small modular nuclear reactors, abated natural gas-fired electricity generation, stationary electricity storage systems, such as batteries, and equipment for the transmission of electricity between provinces and territories.

- Expansion of eligibility to include Geothermal energy for the Clean Technology Investment Tax Credit, which provides businesses that adopt clean technology a 30 per cent refundable rate.

- Eligibility for the Carbon Capture, Utilization, and Storage (CCUS) Investment Tax Credit has also been expanded. Critical details, however, will only be available once the associated package of legislative proposals are released for consultation in the coming months. The tax credit will be retroactively available to businesses that have incurred eligible CCUS expenses, starting in 2022.

- The Strategic Innovation Fund will direct up to $1.5 billion of its existing resources towards projects in sectors including clean technologies, critical minerals, and industrial transformation.

Tax changes

International tax reform

Canada is one of 137 members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting that joined a two-pillar plan for international tax reform agreed to in October 2021.

Pillar One of the plan will ensure that the largest and most profitable global corporations, including large digital corporations, pay their fair share of tax in the jurisdictions where their users and customers are located. Tuesday’s budget announced that Canada is working with our international partners to complete negotiations and sign a treaty to implement Pillar One by mid-2023. To stay ahead of the multilateral agreement, the federal government will move ahead with legislation for a Digital Services Tax but with the hopes that timely implementation of the multilateral system in 2023 will make the legislation unnecessary.

Pillar Two would ensure that large multinational enterprises are subject to a minimum effective tax rate of 15 per cent on their profits in every jurisdiction in which they operate. Budget 2022 proposes to implement Pillar Two in Canada, along with a domestic minimum top-up tax. Tuesday’s budget reaffirms Canada’s intention to introduce legislation implementing the Pillar Two global minimum tax. The primary charging rule for Pillar Two and a domestic minimum top-up tax would be effective for multinational corporations with fiscal years beginning on or after December 31, 2023. The secondary charging rule would be effective for fiscal years that begin on or after December 31, 2024.

Reforms to the Alternate Minimum Tax (AMT)

Budget 2023 announced on Tuesday the alternative minimum tax rate will rise from a minimum of 15 per cent to 20.5 per cent – which means that the ultra-rich won’t be able to pay less than 20.5 per cent in income tax no matter what deductions they are eligible for. This change in anticipated to recoup $3 billion over five years.

Tax exemption on dividends

The tax fairness measure will remove the exemption for dividends received on Canadian shares held by financial institutions (banks) as business income. This will recoup $3.1 billion over five years.

Credit card fees

In last November’s fall economic statement, the federal government said that it intended to “enter into negotiations” with payment card networks, financial institutions, acquirers, payment processors and businesses to lower credit card transaction fees for small businesses while seeking to protect “existing reward points for consumers”. Last fall’s update also said, “should the industry not come to an agreed solution in the months to come, the government will introduce this legislation at the earliest possible opportunity in the new year and move forward on regulating credit card transaction fees.”

Budget 2023 announced the government has secured commitments from Visa and Mastercard to lower fees for small businesses, while also protecting reward points for Canadian consumers offered by Canada’s large banks.

Share buy-backs for public companies

Budget 2023 announces that the proposed tax would apply as of January 1, 2024 to the annual net value of repurchases of equity by public corporations and certain publicly traded trusts and partnerships in Canada. A business would not be subject to the tax in a year if its gross repurchases of equity were less than $1 million.

Digital Services Tax

The federal government will continue to advance legislation on a Digital Services Tax (DST). Canada hopes the timely implementation of a new multilateral system with countries in the G7 and OECD will make the DST unnecessary.

“Junk Fees”

Budget 2023 announced the government’s intention to work with regulatory agencies, provinces and territories to reduce junk fees to Canadians, including higher telecom roaming charges, event and concert fees, excessive baggage fees, and unjustified shipping and freight fees. These details are yet to be outlined and will be announced once consultation with stakeholders is complete.

Predatory lending

The federal government will introduce changes to the Criminal Code to lower the criminal rate of interest from the equivalent of 47 per cent APR to 35 per cent APR, and to launch consultations on whether the criminal rate of interest should be further reduced.

Additional highlights

Via Rail: Budget 2023 proposes to provide $210.0 million over five years, starting in 2023-24, with $117.4 million in remaining amortization, to VIA Rail to conduct maintenance on its trains on routes outside the Québec City–Windsor Corridor and to maintain levels of service across its network.

Canadian Space Agency: Budget 2023 proposes to provide $1.2 billion over 13 years, starting in 2024-25, to the Canadian Space Agency to develop and contribute a lunar utility vehicle to assist astronauts on the moon.

Forestry support: Budget 2023 proposes to provide $368.4 million over three years, starting in 2023-24, to Natural Resources Canada to renew and update forest sector support, including for research and development, Indigenous and international leadership, and data.

Indigenous health priorities: $810.6 million over five years, beginning in 2023-24, to support medical travel and to maintain medically necessary services through the Non-Insured Health Benefits Program, including mental health services, dental and vision care, and medications.

Gottfriedson Band Class Settlement Agreement: Budget 2023 provides $2.8 billion as part of the Band Class settlement, to establish a trust to support healing, wellness, education, heritage, language, and commemoration activities. The government will also propose legislative amendments to exclude the income and gains of the trust from taxation.

Protecting freshwater resources: Budget 2023 proposes to provide $650 million over ten years, starting in 2023-24, to support monitoring, assessment, and restoration work in the Great Lakes, Lake Winnipeg, Lake of the Woods, St. Lawrence River, Fraser River, Saint John River, Mackenzie River, and Lake Simcoe.

Official Languages: Budget 2023 proposes to provide $373.7 million over five years, starting in 2023-24, in additional funding to support new and enhanced federal initiatives under the Action Plan for Official Languages, 2023-28.

Support for Ukraine: Budget 2023 provides Ukraine with an additional loan of $2.4 billion for 2023, which will be provided via the IMF Administered Account for Ukraine, as well as $200 million in 2022-23 to the Department of National Defence for donations of existing Canadian Armed Forces military equipment to Ukraine, including eight previously announced Leopard 2 main battle tanks.

Improved airport operations: Budget 2023 proposes to provide $1.8 billion over five years, starting in 2023-24, to the Canadian Air Transport Security Authority (CATSA) to maintain and increase its level of service, improve screening wait times, and strengthen security measures at airports.

Improved passenger rights: Budget 2023 proposes to amend the Canada Transportation Act to strengthen airline obligations to compensate passengers for delays and cancellations. These changes will align Canada’s air passenger rights regime with those of leading international approaches and ensure that Canadians are fairly compensated for travel delays that are within airlines’ control.