On Thursday, Ontario’s Minister of Finance Peter Bethlenfalvy tabled the 2023 provincial budget, “Building a Strong Ontario,” at Queen’s Park. In Premier Ford’s first budget since the 2022 provincial election, the government emphasizes its plan to navigate global economic uncertainty and lay a strong fiscal framework for the future, with an approach to help people and businesses. It also gets the budget on a fast track to balance in a period of high inflation and interest rates. Budget 2023 reduces the deficit by billions of dollars from the Budget 2022 and the Fall Economic Statement.

Economic projections

Ontario’s 2022-23 deficit is projected to be $2.2 billion – $17.7 billion lower than the outlook published in the 2022 Budget and $4.4 billion lower than the outlook published in the 2022-23 third quarter finances.

Government is projecting a deficit of $1.3 billion in 2023-24 and is on track to post a surplus of $200 million in 2024-25, three years earlier than forecasted in the 2022 Budget. The government is also projecting a surplus of $4.4 billion in 2025-26.

Ontario’s real GDP grew by an estimated 3.7% in 2022 and is projected to increase by 0.2 percent in 2023, 1.3 percent in 2024, 2.5 percent in 2025 and 2.4 percent in 2026. For the purposes of prudent fiscal planning, these projections are slightly below the average of the private sector forecasts.

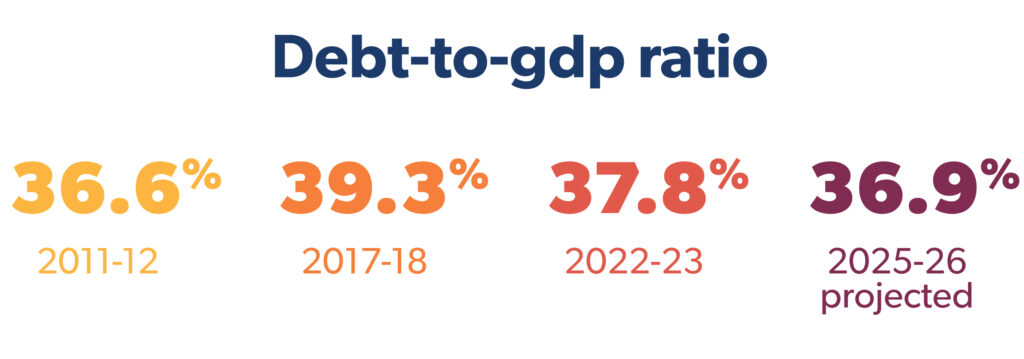

The new debt-to-GDP ratio is projected to be 37.8 percent in 2022-23 – the lowest level since 2011-12.

Over the medium-term outlook, Ontario’s new debt-to-GDP ratio is now forecast to be 37.8 percent in 2023-24, 37.7 percent in 2024-25, and declining to 36.9 percent in 2025-26.

Fiscal prudence is back

Budgets are always about choices, large and small. In this budget, the Ford government has opted to return quickly to one that is more or less in balance. Over the course of the COVID-19 pandemic, the Ford government’s long-standing interest in balancing the budget to avoid adding further to a significant intergenerational debt transfer took second place to the extraordinary demands of the pandemic. Now, with COVID-19 largely behind us, and the opportunity for budgetary balance within reach, fiscal discipline has clearly returned as a priority. Controlling public expenditures carefully fits well with the government of Ontario’s core values and may well be timely as a way to limit the impact of public spending on inflation.

Beyond the targeted initiatives included in this budget, on-going inflation will contribute to a variety of unwelcome and politically challenging pressures on provincial expenditures. Upwards of 70 per cent of Ontario’s annual operating expenditures are in respect of the wages and salaries of the people who deliver provincial services, with most of those workers covered by collective bargaining agreements. Saying no to wage demands from health care workers, police or other highly valued public sector employees is always tough; saying no when the province is at or near fiscal balance is particularly tough.

Inflationary pressures will inevitably begin affecting the costs of capital projects, the cost of third-party contractors the province relies upon to help deliver public services, as well as the costs of supplies the government of Ontario must purchase for its own purposes.

On-going inflationary pressures will be difficult for the province to resist, even through the relatively short term. While a substantial contingency has been set aside through the medium term, a variety of forces and demands inevitably emerge as the budgetary year proceeds, leading to a natural tendency to keep the proverbial powder dry. This may suggest that, where the province truly has discretion over whether to make a net new spending decision, that choice will be given extra scrutiny.

A path to budget balance, but at what cost?

Perhaps the most intriguing line from the economic projections of the budget and the path to balance three years earlier than previously anticipated, in time for the 2026 provincial election. The reduction of the deficit to $2.2 billion for the 2022-23 fiscal year is more than $15 billion less than had been projected in last year’s budget, and more than $4 billion less than projected in the Fall Economic Statement. This drastic reduction gets the government on an ambitious path back to a balanced budget and a $200 million surplus by next year.

After the initial reduction was posted in the fall of 2022, the opposition NDP was quick to highlight overall health spending in the first two quarters of 2022-23 was 2.4 per cent less than expected – an $859 million reduction in real dollars. “It’s unconscionable,” Waterloo NDP MP Catherine Fife said to media in November, “in the middle of a health care crisis, the Ford government is choosing to underspend on health care by almost $900 million.” Spending on education was also $413 million less, and $244 million less on children and social services spending.

In the coming days and weeks, expect the opposition NDP and Liberal parties to continue to press the PC government on promising record investments, but instead delivering unexpected savings and reduced spending.

Ontario made

Budget 2023 launches the Ontario Made Manufacturing Investment Tax Credit, which would provide a 10 per cent refundable corporate income tax credit to help local manufacturers.

Since taking office in 2018, the government under Premier Ford has taken steps to attract industrial development, it’s clear the Ontario government wants the province to be a leader in electric vehicle (EV) and battery production and keep critical minerals in Ontario for processing, refining, and manufacturing.

The government is committed to attracting over $16 billion investment by global automakers and suppliers of EV batteries and battery materials to position Ontario as a global leader in the EV supply chain. This amount does not include the recent announcement for a subsidiary of Volkswagen AG to establish an EV battery manufacturing facility in St. Thomas, outside of London.

Ahead of the 2022 budget, the provincial government launched Ontario’s Critical Minerals Strategy for 2022-2027, to position the province as a global leader of responsibly sourced critical minerals, essential to the development of modern technologies and zero emission vehicles. Budget 2023 advances the critical minerals strategy with an investment of an additional $3 million in 2023-24 and $3 million in 2024-25 in the Ontario Junior Exploration Program to help companies identify potential mineral deposits. It also continues to work to build the road to the Ring of Fire region.

Budget 2023 also sets into motion the construction on key infrastructure projects, including the bridge crossing over the future of Bradford Bypass, the next phase of construction for the new Highway 7 between Kitchener and Guelph, continuing work to widen Highway 401 from Pickering through eastern Ontario, and moving ahead with plans to build Highway 413.

Working for workers

As had been revealed by the government in a preview, Budget 2023 includes $224 million for a new capital stream of the Skills Development Fund to leverage private sector expertise and expand training centres, including union training halls. This funding will help private sector and trade unions provide red-seal training and apprenticeships to the next generation of skilled workers.

To help Ontario students become doctors, Budget 2023 invests $33 million over 3 years to add 100 undergraduate seats beginning in 2023, and 154 postgraduate medical training seats in order to prioritize Ontario residents trained at home and abroad beginning in 2024 and going forward. Ontario residents will also continue to be prioritized for undergraduate spots at medical schools in the province. The government will also invest $80 million over three years to further expand nursing education by increasing enrolment by 1,000 registered nurse, 500 registered practical nurse and 150 practitioner seats.

To address the nagging labour shortage, the government proposes the enhancing the Ontario Immigrant Nominee Program with an additional $25 million over three years to attract skilled workers for in-demand professions.

In the research and innovation sectors, Budget 2023 launches the Life Sciences Innovation Fund to help entrepreneurs and innovators in the life sciences bring their ideas and prototypes to the marketplace. It also invests in new critical technology initiatives, including 5G/Next Generation Networks, AI, quantum computing, robotics, blockchain and cyber security.

The budget also includes proposals to enhance consumer protections and improve access to capital for the life insurance and mortgage broker sectors.

Supporting Ontarians

Budget 2023 advances the dual-site project in Toronto and Peel Region toward the next round of approval with an additional investment of $9.6 million to accelerate the construction at Runnymede Healthcare Centre’s First Responders Wellness and Rehabilitation Centre. This proposal will support the full continuum of care for first responders experiencing post-traumatic stress injury and other concurrent mental health disorders.

Connecting more people to mental health and addictions services is also an objective of the government with Budget 2023. In it, an additional $425 million over three years is proposed, including a five per cent increase in the base funding of community-based mental health and addictions service providers funded by the Ministry of Health.

To offer financial support for seniors beginning in July 2024, the budget proposes changes to expand the Guaranteed Annual Income System (GAINS) program. These changes would see 100,000 additional seniors be eligible for the program and the benefit would be adjusted annually to inflation.

To help Ontario’s most vulnerable populations, the government plans to invest in supportive housing with an additional $202 million each year in the Homeless Prevention Program and Indigenous Supportive Housing Program.

The Ford government also uses the budget as an opportunity to call on the federal government to defer the HST on all new, large scale purpose-built rental housing projects in order to tackle the ongoing housing affordability crisis in Ontario.

More support for health and hospitals

Budget 2023 makes a number of short term investments to improve and expand access to health care services. It invests an additional $72 million in 2023-24 to make more surgeries available at community surgical and diagnostic centres. It also accelerates funding in 2023-24 to stabilize the home and community care workforce with nearly $300 million to support contract rate increases and continues investing in 50 hospital projects to add 3,000 beds across the province.

To extend support for immediate health care staffing shortages, the budget provides $200 million in 2023-24 to invest in the Enhanced Extern Program and Supervised Practice Experience Partnership Program. It also provides $60 million over two years to expand existing teams and create up to 18 new primary care teams in communities with the greatest need.

As had previously been announced, the budget further expand pharmacists’ prescription authority for more common aliments, including mild to moderate acne, canker sores, diaper dermatitis, yeast infection, pinworms and threadworms, and nausea and vomiting in pregnancy, beginning in fall 2023.

It also invests more than $174 million over two years to continue the Community Paramedicine for Long-Term Care program.

Additional links

- 2023 Ontario Budget: Building a Strong Ontario

- Building a Strong Ontario: 2023 Ontario Budget [PDF]

- News Release: Building a Strong Ontario

- Highlights of the 2023 Budget: Building a Strong Ontario

- Backgrounder: Economic and Fiscal Overview