Written by Rob Leone on November 9, 2020.

Economists have been interested to determine what kind of recovery jurisdictions like Ontario might face by using letters to paint a graphical image for people to understand. In essence, a “V” shaped recovery signifies a steep halting of the economy with an immediate very quick rebound.

The 2020 Ontario budget seems to be telling us that we are indeed in a “V” shaped recovery. The first sense we get of this is employment. Between June 2018 (the last election) and February 2020 (the month before lockdown), the Ontario economy was humming, with over 300,000 net new jobs created in that period.

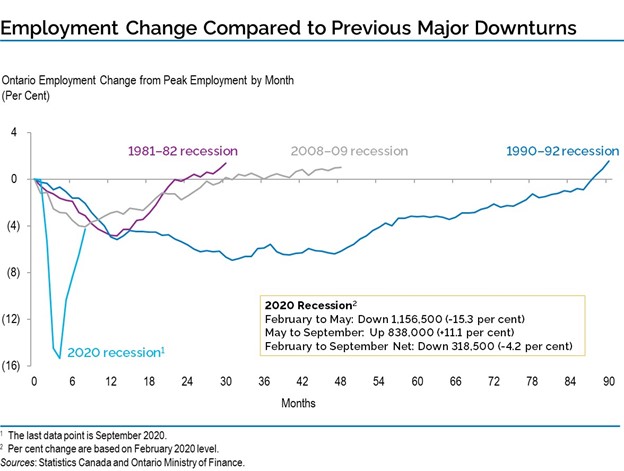

Of course, by May 2020, employment went off a cliff, having dropped more than 1.1 million jobs in Ontario alone, due to the economic shut down. Last week’s budget numbers suggests that by October 2020, almost 75% of the lost employment had been recovered.

Looking at the chart below, we can see the 2020 recession line displaying that “V” shape we have been hoping to see.

The GDP numbers appear to have a similar bounce. While there is considerable variation in private sector GDP forecasting, Real GDP is expected to drop 6.5% in 2020 and bounce back by a very strong 4.9% in 2021. Again, that signals a “V” shape recovery too.

What does this all mean? There were a couple of items we were looking for in the 2020 Ontario budget regarding economic development beyond the data. One of them was whether the Ford government would use the pandemic to abandon its previous objection to “corporate welfare”. There had been some degree of thinking that the government could engage in programs like the ones that emerged federally and provincially after the 2008 financial crisis – including, for example, possibly taking a public stake in large enterprises, other negotiated instruments to financially backstop large companies, or targeted government spending to give them a sharp revenue infusion.

This budget does offer support for businesses, but not in the way “corporate welfare” has historically been viewed. Rather than offer a specific program to fund economic development to specific recipients, the government instead has taken a broad-based approach from a tax perspective. The big-ticket items on this front consists of relief from the Employer Health Tax and reductions in property taxes for businesses. Rather than taking a very narrow focus with grants, the government has instead used tax policy to provide relief for all qualifying businesses. As a result, tens of thousands of businesses stand to benefit.

The other interest on the economic development front pertains to Invest Ontario – the government’s new economic development agency. The intent of the agency is to help market Ontario as a destination to invest and create jobs. It will compete with economic development agencies in Ohio and Michigan that were set up there to do much the same thing.

Making Ontario more tax competitive may be a key competitive differentiator. Invest Ontario is likely to base its pitch to prospective businesses based on currency valuation vs. the US dollar, red tape reduction, health cost savings, new tax measures, and a skilled workforce. Budget 2020 expands training and apprenticeship programs to help meet the needs of skilled trades jobs that are in demand. While the big grant programs are not available to Invest Ontario, some other aspects in Budget 2020 will be helpful as Invest Ontario seeks to attract foreign investment.

This is the first major government to provide a glimpse into how to manage the economic recovery. With a projected “V” shape, the government has chosen not to add additional spending in the form of grants to prop up job creation, as recovery seems to be occurring with the money currently circulating. With the election of Joe Biden as president of the United States, and his promise to significantly raise corporate tax rates, holding off on big grants at this time might just be the best policy choice. Ontario may become an even more attractive place to invest as a result.