Today’s Fall Economic Statement (FES) comes at an economically and politically challenging time for Ontario Premier Doug Ford’s PC government. When the government tabled its spring budget (titled ‘Protect Ontario’) last May, Finance Minister Peter Bethlenfalvy outlined a challenging road ahead for Ontarians due to the ongoing trade dispute with the province’s largest trading partner. Six months later, the volatility and escalation of the trade dispute show few signs of letting up, with a series of high-profile developments shaking the core of the province’s manufacturing sector.

Setting the scene

It has been a hectic few weeks for the Ford Government as they put together this FES. Ontario’s automotive sector has experienced a particularly turbulent few weeks which saw Stellantis cancel plans for a new line and threaten over 3000 jobs, while moving and investing over $13 billion into U.S. operations instead. Shortly after, General Motors announced it would close operations in Ingersoll, which affects over 1,000 jobs, with potentially more layoffs coming at its Ultium battery plant.

The Premier has also faced questions on nearly a daily basis from opposition parties regarding the multi-billion-dollar Skills Development Fund, following an Ontario Auditor-General’s report, which said the distribution of $1.3 billion in training grants was “not fair, transparent or accountable.” Labour Minister David Piccini has held onto his role throughout the affair, with the Premier maintaining he has confidence in his minister while continued reporting has showed funds were more likely to flow to organizations with connections to the Progressive Conservative government either directly or indirectly.

Making ends meet?

Important context leading into this FES is that Ontario is the first province that is facing significant fallout caused by the ongoing trade and tariff battle with the United States. Due to the provinces manufacturing sector being disproportionately exposed to these tariffs, unlike other sectors and jurisdictions in the country, we are seeing the effects on the economy already. Job growth has flattened and outyear predictions are much lower than previously estimated.

Tuesday’s federal budget disappointed Ontario’s government by not responding with the previously promised initiatives to improve interprovincial trade and ensure there were no direct hits form the ongoing U.S. tariff threat. The FES focused on backstopping communities that will be particularly affected by loss of automative sector jobs while also emphasising the economic outlook is still soft and subject to uncertain trade futures and supply chain issues.

However, the large $13.5B deficit this fiscal year is a billion dollars lower than the $14.6B deficit predicted in the spring budget. The deficit is expected to shrink to $7.8 billion in the 2026-27 fiscal year, followed by a surprise $0.2 billion surplus in 2027-28. This coincides with slowing GDP growth of only 0.8 per cent in 2025, and 0.9 per cent in 2026.

Concerns remain about the cost of living, affordability, and good paying jobs. One issue that is noticeably absent from the forefront of the FES is the environment, which much like we saw in the Federal Budget, has lessened in importance as the public faces the day-to-day stresses of the topics noted above. The role the younger portion of the electorate will play in this is unique, as the group who is not only facing some of the largest economic challenges but also the one who tends to hold climate issues closer to their hearts. This may all play out as the Ontario government has laid out that they plan to repeal parts of the 2018 Cap and Trade Cancellation Act in today’s FES. It says the government will repeal the sections requiring the province to establish emissions reductions targets, prepare a climate plan and issue progress reports. The law has been critical in a youth-led court challenge arguing the government’s current plan offers so few protections that it endangers the lives of Ontario’s young people.

While the FES offers a bridge in uncertain times to auto sector workers bearing the brunt of the trade war currently, there is no immediate relief for middle-income Ontarians and young people. With the federal budget also not addressing the personal-level challenges of increased costs, Ontarians continue to face an uncertain financial future with no short-term government relief.

Key numbers

In the 2025 Ontario Budget, the chosen fiscal anchors included:

- Keeping net debt-to-GDP below 40 per cent.

- Keeping debt-to-operating revenue below per cent.

- Keeping net interest-to-operating revenue below 7.5 per cent.

The FES provided updated predictions to these goals, which are largely unchanged from the predictions in the Budget, with two measures revised slightly downwards:

- Forecast for the 2025-26 net debt-to-GDP ratio at 37.7 per cent.

- Down from 37.9 per cent in the 2025 Budget’s forecast and a 13-year low.

- Forecast for the 2025-26 net debt-to-operating revenue at 208 per cent.

- Down from the 2025 Budget prediction of 211 per cent, but still over target.

- Forecast for the 2025-25 net interest-to-operating revenue at 6.4 per cent.

- Down from the 2025 Budget prediction of 6.5 per cent.

The FES predicts Real GDP growth to decelerate to 0.8 per cent for 2025 and 0.9 per cent for 2026 as U.S. tariffs continue to impact Canada’s economy through reduced exports, slowing investments, hiring freezes, and layoffs. The government forecasts a nearly return to its long-term average trend of 1.8 percent in 2027 and 1.9 per cent in 2028, still lower than predicted in a tariff-free scenario.

The provincial net debt-to-GDP ratio in 2025-26 is now projected to be 37.7 per cent, which is 0.2 per cent lower than forecasted in the 2025 Budget. This trend continues over the medium term, where the debt-to-GDP is expected to remain lower than forecasted in the 2025 Budget and continues to be below target levels.

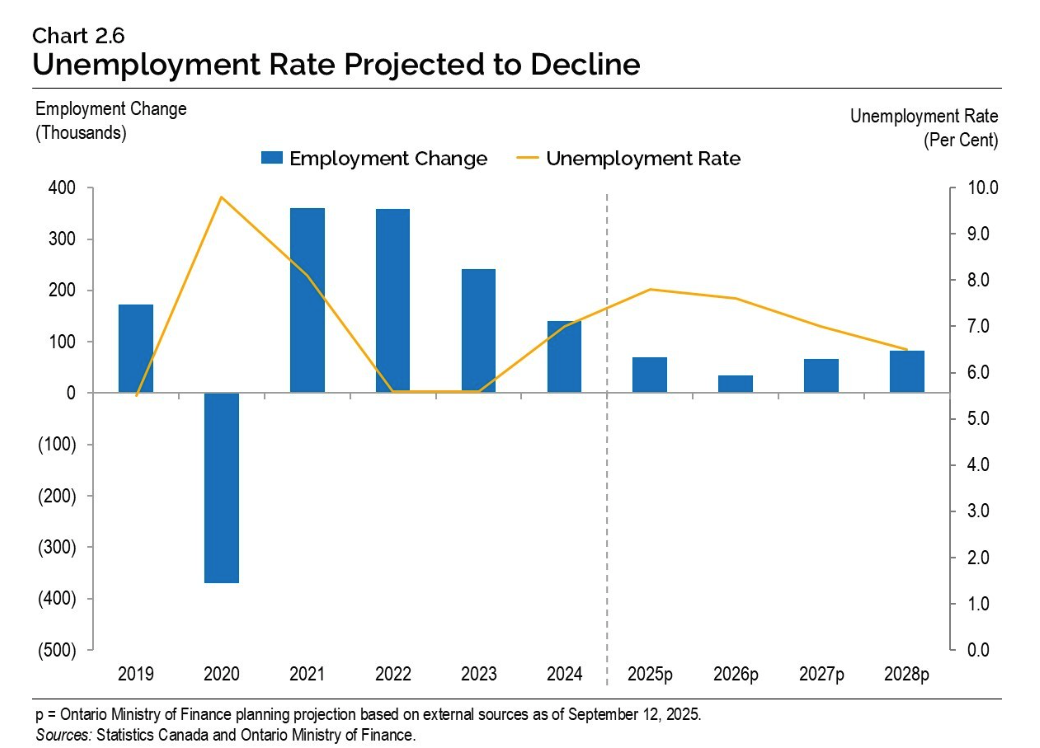

This year, employment growth rose in the first quarter, then declined in the second. Employment growth is projected to rise 0.9 per cent overall in 2025, 0.4 per cent in 2024, 0.8 per cent in 2027, and 1.0 per cent in 2028. Uncertainty around reduced trade between Canada and the U.S. is expected to impact Ontario disproportionately compared to other provinces and territories due to Ontario’s economy hosting a larger share of tariff impacted industries.

The FES forecasts provincial revenue for this fiscal year will reach $223.1 billion, $3.2 billion higher than the $226.3 billion prediction of the province’s 2025 Budget. Increased revenues are said to be driven by stronger taxation revenue and non-tax revenue from the public sector. However, government expenditures are projected to grow by $2.1 billion to reach $234.6 billion in 2025-26.

The document also forecasts an even steeper drop in housing construction starts than the government had expected in May. Ontario now predicts just 64,300 housing starts in 2025-26, down from its earlier projection of 71,800.

Notable announcements

Highlights and notable announcements from the 2025 Fall Economic Statements include:

- Providing a rebate for the provincial portion of the HST for first-time home buyers of most new homes.

- This is contingent on the passage of federal legislation, but it would eliminate the entire 8% provincial portion of the HST on qualifying new homes valued up to $1 million

- Developing the Ontario Tax Action Plan, which focuses on updating Ontario’s personal and corporate income taxes to help encourage and attract more business investment. This will also improve Ontario’s competitiveness in the G7.

- An update on the Tax Action Plan will be provided in the spring in the 2026 Ontario Budget.

- Investing an additional $100 million in the Ontario Together Trade Fund (OTTF) to help small and medium-sized businesses enter new markets and strengthen trade resilience.

- This brings the total funding for the program to $150 million over three years, starting in the 2025-26 fiscal year.

- Introducing legislation to enhance and expand the Ontario Made Manufacturing Investment Tax Credit will include proposing to temporarily enhance the tax credit rate from 10% to 15% and expand access to the tax credit to corporations that are not Canadian-controlled.

- Additionally, to amend the OMMITC eligibility criteria for investments in machinery and equipment to provide greater flexibility for businesses.

- The government is developing the second and third streams of funding for the remaining $4 billion in the Protecting Ontario Account.

- Planned investments totalling more than $201 billion over 10 years, including $33 billion in 2025-26.

- Investing $1.1 billion over 3 years to increase in home care ($982 million) and support the expansion of the Hospital to Home program ($170 million).

- The Building Ontario Fund will contribute up to $1 billion to an equity investment in the Darlington New Nuclear Project (DNNP).

- This fund was announced in the 2025 Ontario Budget, and it focuses on delivering priority investments.

- Enhancing the Ontario Municipal Partnership Fund through a $100 million increase in funding over the next two years, bringing the overall funding envelope to $600 million annually.

Opposition response

A trending theme emerged as opposition parties had their chance to express their thoughts on the government’s FES, largely centering on the government’s plan to help everyday Ontarians face the economic challenges ahead.

The Ontario NDP criticized the FES for failing to deliver a real plan that helps families and workers. They described the outlook as having “rose coloured glasses” and not addressing the jobs crisis, rising cost of living, the deepening housing crisis or issues with the landlord and tenant board, and that lackluster economic growth will lead to cuts in education and health services.

They also suggested that affordability was not addressed, noting the low job forecast, and that despite inflation cooling, the cost of food is still high, highlighting that a disproportionate amount of people utilizing food banks are between ages 18-49. The NDP raised the ongoing Skills Development Fund scandal, saying the money should be going to colleges and universities.

Ahead of the statement, the Ontario NDP called for a plan that:

- Protects and creates good jobs by expanding supports for local manufacturing, small businesses, and Ontario’s resource sectors.

- Invests in social infrastructure like housing, health care, education, and childcare to attract and retain workers.

- Builds economic security through higher social assistance rates, expanded public pharmacare and mental health care, and municipal supports to prevent job loss and homelessness.

- Grows sustainable industries with public investment in clean manufacturing, forestry, and mining jobs that stay in Ontario.

They argued Ontarians need a strategy that makes life more affordable and strengthens communities, not “empty announcements” or measures that benefit wealthy insiders.

The Ontario Liberal Party also criticized a lack of relief for middle income families, or tax cuts for small businesses suffering under U.S. tariff measures, and pointing to “rising poverty, crumbling hospitals, underfunded schools and still, no plan to prioritize what families need to get ahead.”

The Green Party of Ontario spoke out against the FES, saying it “has no plans to help out everyday Ontarians.” They took issue with the lack of affordability measures, unemployment, and the ongoing controversial plan to tunnel under the 401.