The Ontario government tabled its 2025 Budget this afternoon, titled “Protect Ontario”. In this provincial budget, the government looks to address many of the key issues that carried the Ford government to a third majority election victory earlier this year.

Leading up to Budget 2025, with a large mandate to address the U.S. tariff threat, the Ford government wasted no time renewing efforts to reduce red tape and streamline approval processes in resource/energy development (Bill 5) and housing development (Bill 17). Budget 2025 is framed in the same context and theme of encouraging economic growth. This budget comes on the heels of bad news in the automotive sector – with both Honda’s pause of the planned $15 Billion battery & EV plant and layoffs announced by various automotive manufacturers.

Premier Ford and Nova Scotia Premier Tim Houston have been leading the charge among provincial premiers on removing interprovincial barriers. Like Nova Scotia, Ontario has tabled a free trade within Canada bill (Bill 2) which is focused on the removal of barriers particularly in terms of beverages, alcohol, trades and labour mobility. These efforts form part of overall federal provincial efforts to work towards a “one economy” result and announcement by July 1.

PC Party of Ontario support levels remain steady at 46% according to the last two public surveys, the latest published May 9. Ontario’s New Democrats, while having won enough seats to form the Official Opposition during the February election has experienced a 10-point drop in support over the last five months. Bonnie Crombie’s Liberals have benefitted from this drop, rising to 36% as of May 9.

The government is focused on what spending may be needed to get through turbulent economic times rather than saving and balancing the books. The province’s fall economic statement had projected a balanced budget for 2026-27, but that came before the election of Trump and the implementation of tariffs.

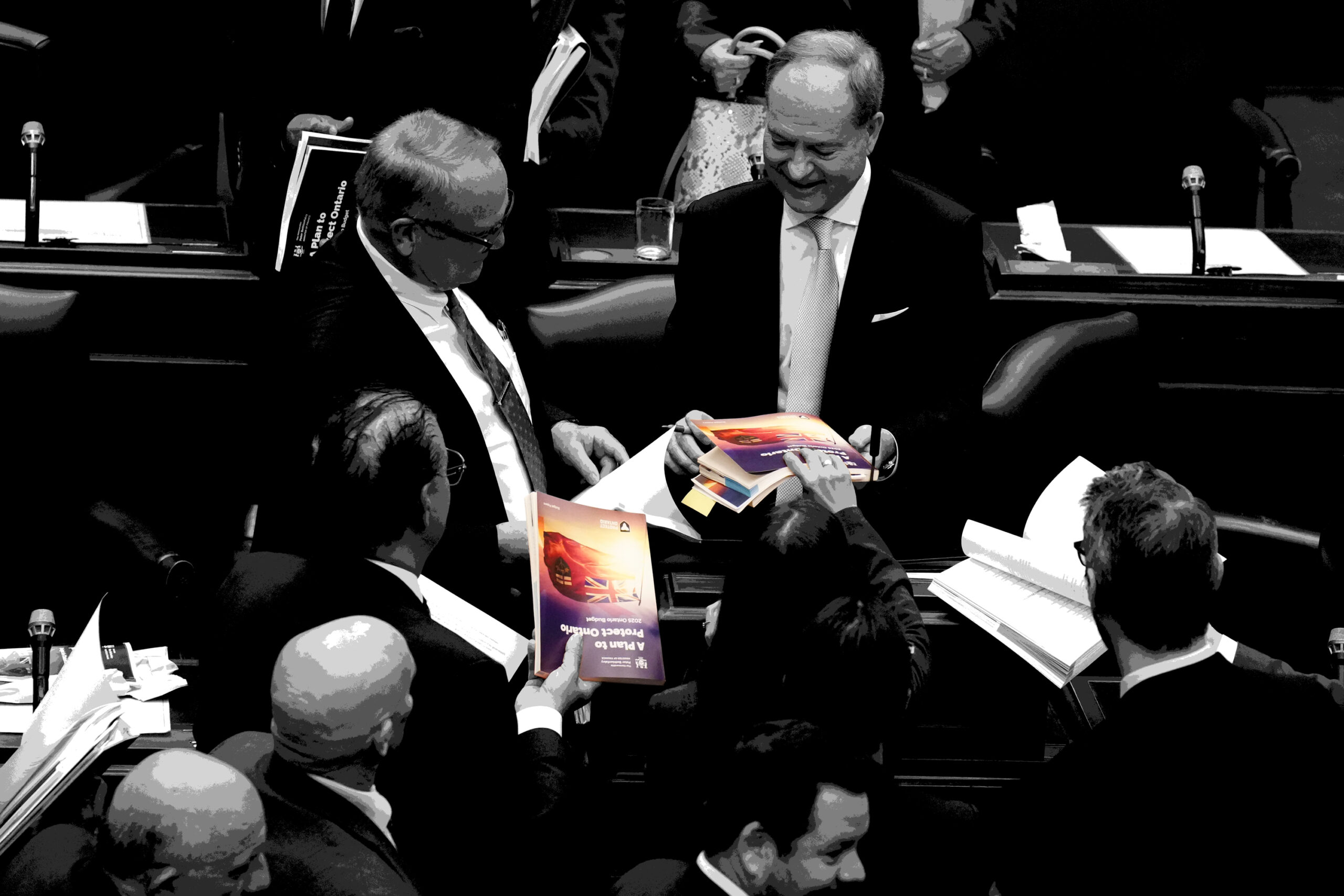

During a speech prior to the budget being released, Finance Minister Bethlenfalvy signalled the status quo for the Ford government was no longer an option, given the current situation with the U.S. This theme continued throughout his delivery of the speech on budget day, outlining the government’s focus on building the future economy of Ontario, one that is self-sustaining and resilient, through the development its key resources and support for workers in the manufacturing sector.

These tariffs, imposed by the U.S., have been a wake-up call for Canadians, a wake-up call that highlights the underlying issues we face as an economy, and a nation. But now is not the time for fear of tariffs and uncertainty, now is the time for growth and improvement.

— Finance Minister Peter Bethlenfalvy

Major initiatives in the budget include

- A $200 billion capital plan over the next 10 years. This includes more than $33 billion in 2025–26. Highlights of the 10-year capital plan include:

- Nearly $30 billion to support the planning and construction of highway expansion and rehabilitation projects.

- $61 billion for public transit.

- $56 billion in health infrastructure.

- Over $30 billion to build more schools and childcare spaces.

- Providing up to $5 billion for the Protecting Ontario Account, to provide businesses with critical support to protect jobs, transform businesses, grow sectors of the economy, and support businesses affected by tariff related disruptions.

- An additional $5 billion to the Building Ontario Fund to partner Canadian institutional investors to help unlock infrastructure projects in the key priority sectors like energy, affordable housing, long-term care and transportation.

- Investing $500 million to create a new Critical Minerals Processing Fund (CMPF).

- Investing $207 million over three years starting in 2025-26 in the Ontario Research Fund – Research Infrastructure to provide Ontario universities, colleges and research hospitals with funding to acquire infrastructure and engage in global research and development.

Key figures

As a byproduct of Budget 2025 being developed in a post-tariff landscape, the province is planning on spending a record amount to support businesses and workers through this uncertain economic period. In all, the province plans on spending $235.7 billion in 2025-26. This leads to a deficit of $14.6 billion for 2025-26, which is nearly ten times larger than the $1.5 billion it predicted last fall. The deficit for the following year is projected at $7.8 billion in 2026–27, before returning to a surplus of $0.2 billion in 2027–28. In the fall economic statement, the province had predicted a nearly $900-million surplus for 2026-27.

The large deficit figure for this year includes a $3-billion contingency fund, which grows into the future years. The projections also include a $2-billion reserve fund each year in addition, acting as a contingency for any unplanned major expenditures.

- 2025-26 Budget Deficit – $14.6 billion

- Deficit increase from 2024-25 to 2025-26 – $6.0 billion to $14.6 billion

- Forecast 2026-27 Budget Deficit – $7.8 billion

- Forecast 2027-28 Budget Surplus – $0.2 billion

- 2024-25 Net Debt-to-GDP ratio – 36.3%

- Forecast 2025-26 Net Debt-to-GDP ratio – 39.5%

- Forecast 2026-27 Net Debt-to-GDP ratio– 37.9%

- 2025 Real GDP Growth – 0.8%

- Forecast 2026 Real GDP Growth – 1%

- Forecast 2027 Real GDP Growth – 1.9%

Economic outlook

Ontario’s real GDP is projected to rise to 0.8 per cent in 2025, then increase by 1.0 per cent in 2026 and by 1.9 per cent in both 2027 and 2028. Real GDP forecasts are lower over the projection period compared to the 2024 Budget, largely due to the impacts of the U.S. trade policies and related uncertainty. The government points out that they have been prudent in these projections by adjusting them slightly below the average of private-sector forecasts.

Revenue amounts are expected to total $219.9 billion in 2025-2026. Over the years covered by the financial projections, revenue growth is expected to increase gradually, reaching $237.9 billion in 2027-28. Total expenditures, which include debt servicing, stand at $235.7 billion in 2025-2026, which is an increase of $4.9 billion from 2024-25. Interest and other debt servicing charges alone are forecast to be $15.2 billion in 2024-25, down from the 2024 Budget forecast of $16.5 billion. However, debt servicing charges are expected to rise nearly 1% from 2024-25 to 2025-26, back up to $16.2 billion.

The government also provided an update on the three fiscal anchors that they have chosen to adhere to, these include:

- Keeping net debt-to-GDP below 40%.

- Keeping debt-to-operating revenue below 200%.

- Keeping net interest-to-operating revenue below 7.5%.

The government meets most of the anchors they have set out for themselves, with net debt-to-GDP being forecasted at 36.3% for 2024-25, and 39.5% & 37.9% in 2025-26 and 2026-27 respectively. Net interest-to-operating revenue also remains below the 7.5% target, at 5.8%, 6.8% and 6.5% from 2024-25 through to 2026-27.

The government misses the mark as it relates to debt-to-operating revenue for much of the forecast period. Budget 2025 forecasts the 2024-25 net interest-to-operating revenue ratio to be 195%, down from the 214% that was projected in Budget 2024. However, this is the only projection that comes in below the 200% anchor they set out, with the following years in the period forecast to be 211%.

Real GDP growth is expected to slow throughout the forecast period, coming in at just 0.8% in 2025 and rising to 1.9% in 2027 & 2028 as the economic uncertainty weighs on the economy. In the government’s fall economic update, real GDP growth for 2025 was forecast to be 1.8%, marking a halving of the rate due to the implementation of the U.S. tariffs.

Ontario’s Plan to Build

As a focal point of Budget 2025, and the centre point of the province’s plan to combat the economic uncertainty ahead, the government has created “Ontario’s Plan to Build”. This is the government’s long-term strategy to provide over $200 billion in capital investments over 10 years, including $33 billion in 2025–26 alone. This is the largest capital plan in the province’s history and aims to tackle the infrastructure deficit by building critical assets across Ontario.

These infrastructure investments focus on major areas such as highways, public transit and community infrastructure, with a large focus on ensuring these projects are not only built but built faster. These infrastructure projects are aimed at not only building infrastructure, but ensuring workers and industry remain active in the province through difficult economic times. Some of these projects include:

- Building new major highways — such as highway 413 and the Bradford Bypass.

- Expanding existing highways — including the tunnelled expressway under the 401 as previously announced.

- Expanding subway service by at least 50 per cent.

- Expanding and implementing the GO 2.0 plan.

- An additional $5 billion to the Building Ontario Fund to co-invest in key priority areas such as long-term care, energy infrastructure, and affordable housing.

- $400 billion in additional funding for the Housing-Enabling Water Systems Fund.

Additional infrastructure investments include:

- Introduction of a new Ontario Shortline Railway Investment Tax Credit. A 50 per cent refundable corporate income tax credit for capital and labour expenditures for railway-related maintenance.

- The credit would be limited to $8,500 per track mile in Ontario and would be available for eligible expenditures made on or after May 15, 2025, and before January 1, 2030.

Protecting Businesses from Tariff Uncertainty – Immediate Relief and Long-Term Sustainability

Budget 2025 introduces the government’s $11 billion relief and support package that includes immediate assistance for tariff-impacted sectors, targeted tax relief, community and workforce supports, and long-term investments to build economic resilience and reduce dependency on U.S. trade.

This includes the province’s plan to provide a $9 billion, six-month interest and penalty-free period, for Ontario businesses under select provincially administered taxes. During this period, penalties and interest will not be applied to businesses who choose to defer the payment. From April 1, 2025, to October 1, 2025, all businesses who pay taxes under 10 of Ontario’s business-focused tax programs can defer payments for taxes owed, without incurring interest and penalties.

The government is also supporting workers directly, with $20 million in 2025–26 to launch new training and support centres across the province. The Workplace Safety and Insurance Board will also return $4 billion in surplus funds to safe employers in 2025.

To protect the economy, Ontario is launching the Protecting Ontario Account (POA) with up to $5 billion being available, including $1 billion in immediate liquidity relief and $4 billion for future business support programs to help affected sectors transform and remain competitive.

To help industry and communities who are facing regional trade-related difficulties, Budget 2025 includes the new Trade-Impacted Communities Program. This will provide $40 million in grants starting in 2025-26, to help industries and municipalities respond to trade disruptions, pivot to domestic supply chains and develop strategic grown initiatives.

Despite the recent challenges in the sector, Budget 2025 reaffirmed Ontario’s commitment to the electric vehicle (EV) and battery supply chain. To sustain growth in this sector, the province is investing $85 million, including $73 million in the Ontario Vehicle Innovation Network (OVIN) and $12 million for the Ontario Automotive Modernization Program (O-AMP).

As part Phase 2 of the Life Science Strategy, the government is investing an additional $15 million to renew the Life Sciences Innovation Fund (LSIF) for three years beginning in 2025-26. The LSIF program is a co-investment fund that addresses challenges in the venture capital sector by providing early-stage funding to life sciences companies that are raising seed or pre-seed investment rounds. For early-stage Ontario companies, the government will provide an additional $90 million in venture capital funding through Venture Ontario. This includes $40 million specifically designed to help life sciences companies and biomanufacturers innovate and grow.

Additional investments include:

- An additional $600 million to the Invest Ontario Fund.

- $200 million to support the shipbuilding industry and the broader marine sector, starting with the new Ontario Shipbuilding Grant Program.

- An additional $207 million over three years through the Ontario Research Fund – Research Infrastructure (ORF-RI), starting in 2025–26

Economic Sustainability – A more independent and resilient Ontario economy

Budget 2025 focused on the need to break away from its dependence on the U.S. and develop in what the government defines as an “urgent need to bolster Ontario’s economic resilience”. A large part of this strategy can be found in the urgent need to unlock Ontario’s energy and critical mineral resources.

In addition to the Protect Ontario by Unleashing Our Economy Act, 2025, the government will also invest in ensuring processing capacity is developed in the province. This includes the $500 million Critical Minerals Processing Fund, which aims to provide strategic financial support for projects that accelerate the province’s processing capacity to ensure stable supply to Ontario manufacturing as well as the growing global supply.

The government is relaunching the province’s existing $1 billion Aboriginal Loan Guarantee Program (ALGP) as the new $3 billion Indigenous Opportunities Financing Program (IOFP) to support Indigenous participation in more sectors, including electricity, critical minerals, resource development and related infrastructure components. This is in addition to investing $70 million over four years in the Indigenous Participation Fund starting in 2025–26.

The province will launching a new round of the Hydrogen Innovation Fund, investing $30 million to unlock hydrogen’s potential. They are broadening the eligibility criteria to include electricity grid-focused initiatives, as well as applications across other sectors, such as transportation.

Additional investments include:

- $10 million more in 2025–26 to extend the Ontario Junior Exploration Program (OJEP).

- an additional $5 million over two years in the Critical Minerals Innovation Fund (CMIF) starting in 2025–26.

Affordability measures

The government has committed to nearly $12.9 billion aimed at providing relief for families and individuals in the 2024-25 fiscal year. The largest destinations for this funding were the Ontario Taxpayer Rebate, energy initiatives, and the “One Fare” integration on GO and TTC transit.

One of the key affordability measures announced by the Ford government recently and included in Budget 2025 is the permanent reduction of gas tax and fuel tax rates. The Ontario government temporarily cut the Gasoline Tax by 5.7 cents per litre and the Fuel Tax rate by 5.3 cents per litre on July 1, 2022, and has since then extended this cut over four times. The latest extension will end on June 30, 2025. The government has introduced legislation that would amend the Gasoline Tax Act and the Fuel Tax Act to keep the provincial rates on tax on gasoline and fuel at 9 cents per litre, permanently.

The government is also proposing a new refundable Personal Income Tax credit to help Ontario families with their eligible medical expenses related to fertility treatment, starting with the 2025 taxation year. The new Ontario Fertility Treatment Tax Credit would provide Ontario families with support of 25 per cent on eligible expenses up to $20,000, for a maximum tax credit of $5,000 per year.

Additional investments include:

- The government will introduce legislation to amend the Liquor Tax Act, 1996 to reduce the spirits basic tax from 61.5 per cent to 30.75 per cent, effective August 1, 2025.

- Also previously announced and included in the budget is the removal of tolls from Highway 407 East beginning on June 1, 2025.

Health care and community services

Following the spending on infrastructure theme, the budget announced $56 billion in health capital funding, with $103 million in planning grants and support for 3,000 new hospital beds at seven regional hospitals. The hospital system itself will be bolstered by $1.1 billion in available funding, including the 4 per cent base and targeted funding, as well as a direct investment in the surgery system. That system will also see $280 million over two years to Integrated Care Centres—private health clinics—directed at improving access to CT scans and MRIs, as well as locally providing orthopedic and endoscopic procedures.

$1.8 billion was announced two weeks prior to the budget for Dr. Jane Philpott’s Primary Action Plan, which aims to connect 2 million more Ontarians to a primary care provider over the next four years through the creation and expansion of over 300 primary care teams.

The government announced their intent ion to prioritize Ontario medical school seats for Ontario students, while providing $175 million for an expansion of the Learn and Stay grant. This will provide 100% tuition and education coverage for four years starting for medical students in 2024-25 who have committed to staying in Ontario and practicing general medicine. Nursing colleges and universities will see 56.8 million over three years to expand enrolment increases of up to 2,200 nursing students.

In Long-Term Care, a new construction funding support program for long-term care operators and builders is intended to build or renovate 8,000 new or redeveloped beds.

In the Children, Community and Social Services area, new development projects include $16 million to the Luso Canadian Charitable Society for a new facility in Hamilton for aging individuals with disabilities, and $21 million to Safehaven’s Bloor Site redevelopment in Toronto, which supports adults and children with complex care needs.

The budget also announced an additional $175 million in 2025-26 for the Ontario Autism Program, bringing the total investment to $779 million.

This health care funding is directly aimed at stabilizing the system, as well as job creation, with retaining or retraining the health care workforce, and an emphasis on primary care, diagnostics and the surgical system. There is a targeted boost in health capital for smaller centres, which should translate into local jobs in regional areas outside the large urban centres. Long-term care construction and development will see expanded supports. There is also a continued emphasis on primary care and attracting and keeping general medicine students in the province. New funding that is not capital or health human resource related is directed to economic development in life sciences and research. A part of this is the IVF announcement noted in a previous section which specifically focusses on affordability for families facing infertility.

Housing

Budget 2025 included measures to support housing, following Housing Minister Rob Flack’s announcement of the Protect Ontario by Building Faster and Smarter Act, 2025 on May 12, which intends to support new construction through simplifying and standardizing development charges and fees; removing barriers for Canadian manufacturers of building materials, systems and designs; streamlining transit-oriented communities and projects; simplifying development approvals and plans; harmonizing road building standards and municipal requirements.

Budget 2025 commits that starting in 2026, municipalities will have the option to reduce the municipal property tax rate for eligible affordable rental housing units by up to 35 per cent, as defined by the Development Charges Act.

Budget 2025 highlighted investments in municipal infrastructure, including $400 million in the Municipal Housing Infrastructure Program and Housing-Enabling Water Systems Fund, as well as $50 million over five years to increase industrial capacity in modular construction and other innovative options.

Despite these and other measures, however, new housing starts are expected to slow, due in part to economic uncertainty, supply chain pressures and global trade disruptions. The government continues to fall short of its housing targets, with approximately 74,600 housing starts in 2024 and projecting 71,800 this year. Ontario requires approximately 150,000 new homes per year to reach the goal of 1.5 million homes by 2031.

Opposition reactions

NDP Leader Marit Stiles called Mr. Bethlenfalvy’s budget “a missed opportunity” to strengthen the province and referred to Budget 2025 as a “band aid” budget.

The government could have built a tariff-proof future, with good schools, affordable homes, world-class public health care and reliable public services. Instead, the Ford government chose more cuts, less relief and no real support for families who need help right now.

—NDP Leader Marit Stiles

Ontario Liberal Leader Bonnie Crombie called the budget a painful reminder that the government is not helping residents, particularly young people who need affordable housing.

Time and time again, Doug Ford has failed Ontarians. I’m frustrated watching yet again this Premier care more about alcohol, which is mentioned more than 100 times in the budget, than health care.

—Ontario Liberal Leader Bonnie Crombie

Looking ahead

The legislature will resume for two weeks, until rising for an extended summer break on June 5, returning September 8. During this time Members of Provincial Parliament will likely spend time in their constituencies and attend and host local events. Party leaders, government ministers and others will also take the opportunity to visit different regions and engage with stakeholders. Government business will continue, particularly in responding to uncertainty with trading partners and the global economy. Premier Doug Ford will likely highlight the essential role that Ontario plays in Canada’s success and remain a key figure in relations with Prime Minister Mark Carney and the federal Liberal government and other provincial leaders as they come together for the First Ministers’ meeting in Saskatoon on June 2nd.