Facing a period of sustained inflation that threatens to turn into a recession, Deputy Prime Minister and Finance Minister Chrystia Freeland today tabled her Fall Economic Statement.

Context in which the Fall Economic Statement was presented

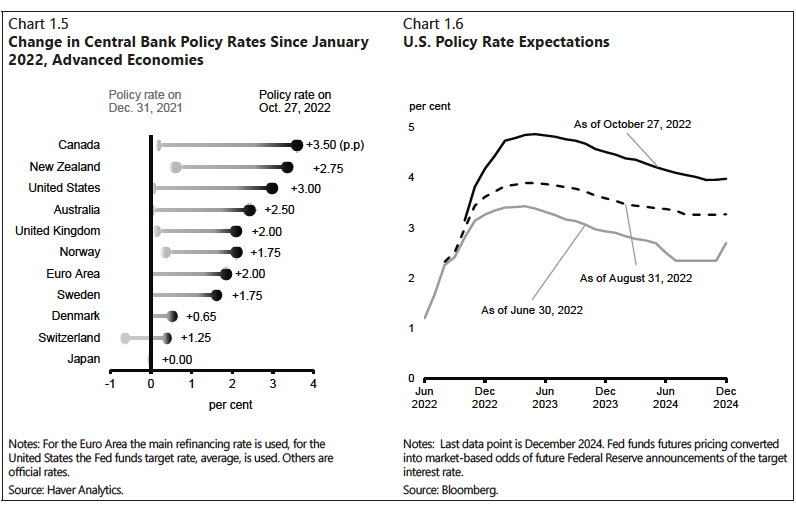

Statistics Canada reported in mid-October that the Consumer Price Index rose 6.9 per cent in September year-over-year, essentially the same rate as the previous two months, and that food prices grew by 11.4 per cent, the fastest pace in over 40 years. In response, the Bank of Canada has raised interest rates six times since March 2 and October 25, from 0.5 per cent to 3.75 per cent.

Last week, Minister Freeland outlined the constraints she faced in preparing the update, warning that “difficult days” lie ahead for Canada’s economy, with higher mortgage rates, businesses no longer booming and higher unemployment in the offing. She also frankly acknowledged the dilemma facing the federal government – how to respond to calls for more help to cushion the impacts of the higher cost of living while needing to restrain higher spending to avoid fuelling more inflation: “We cannot compensate every Canadian for all the costs of inflation.”

Highlights of the statement

Deficit 2021-22

The federal deficit for the last fiscal year was $90.2 billion, significantly smaller than the government’s April projection of $113.8 billion. The reason was higher federal revenues pushed by higher energy prices and inflation and an economy that outperformed earlier expectations.

Deficit 2022-23

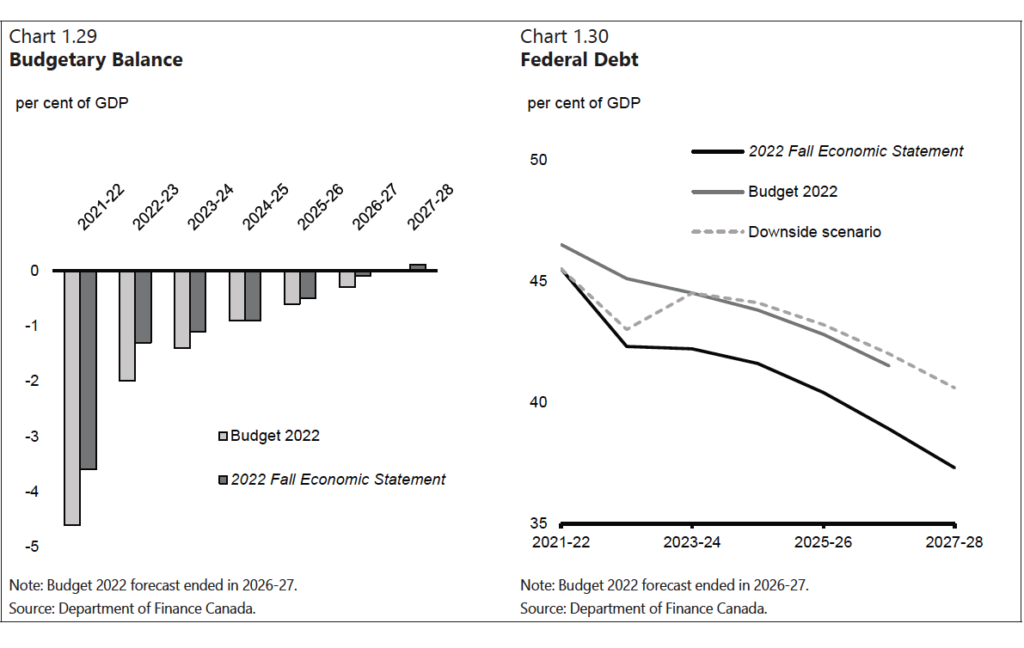

The deficit for the current year is forecast to be $36.4 billion, about -1.3 per cent of GDP, and is expected to shrink over the next four years before turning into a budget surplus of $4.5 billion, or about 0.1 per cent of GDP, during the 2027-28 fiscal year. The deficit for this year is $16.4 billion lower than originally forecast in the spring federal budget, again, largely due to high energy prices buoying government revenues.

The “fiscal anchor”

“Over the next three decades, the federal debt-to-GDP ratio is projected to continuously decline and be on a steeper downward track than projected in Budget 2022.

As economic and financial conditions have deteriorated around the world, Finance Canada has developed a “hard landing” scenario, in which “CPI (Consumer Price Index) inflation is 1.8 percentage points above the September 2022 survey in 2023 and stays above 3 per cent until the first quarter of 2024—about six months longer than in the survey—before reaching 2 per cent by the end of 2024.”

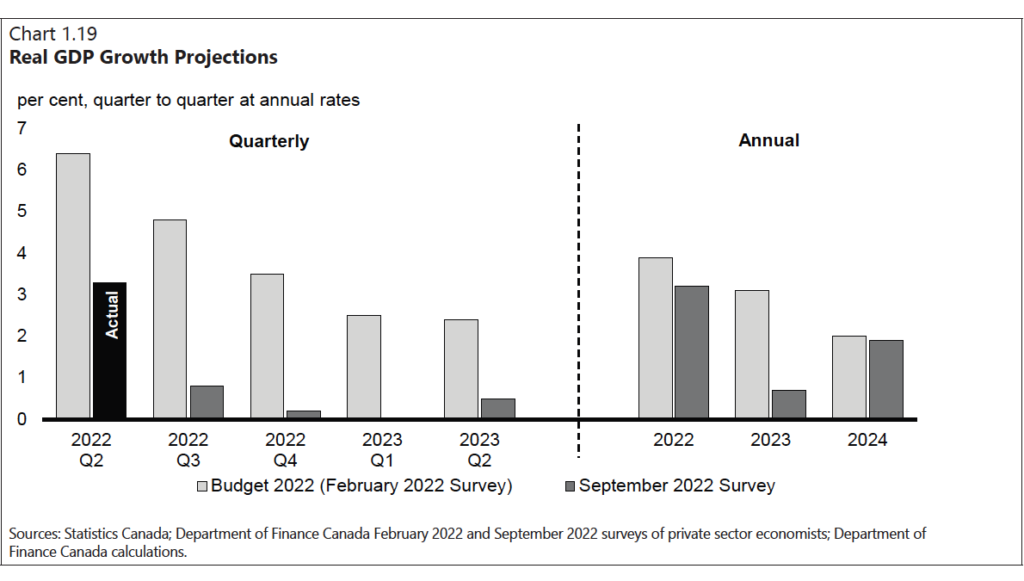

Growth and inflation

The government’s panel of outside economists are forecasting that economic growth will slow further, with CPI inflation projected to remain above 3 per cent until the third quarter of 2023—almost a year later than private sector economists predicted in Budget 2022—before reaching 2 per cent in mid-2024 and employment. Finance Canada’s projected growth rate for the current year is 3.2 per cent and 0.7 per cent for next year, and slightly less for both years under its hard landing scenario.

New spending

Canada Workers’ Benefit

“$4 billion over six years, starting in 2022-23, to automatically issue advance payments of the Canada Workers Benefit to people who qualified for the benefit in the previous year, starting in July 2023 for the 2023 taxation year.”

Student and Apprentice Interest

Proposes to make all Canada Student Loans and Canada Apprentice Loans permanently interest-free, including those currently being repaid, beginning on April 1, 2023. The estimated cost is $2.7 billion over five years and $556.3 million ongoing.

Housing

Several new initiatives, including a new Tax-Free First Home Savings Account, doubling the First-Time Home Buyers’ Tax Credit, introduction of a new, refundable Multigenerational Home Renovation Tax Credit, and ensuring that profits from flipping properties held for less than 12 months are fully taxed, starting in 2023.

Credit card transaction fees for small businesses

“The government intends to enter into negotiations with payment card networks, financial institutions, acquirers, payment processors, and businesses to lower credit card transaction fees for small businesses in a manner that does not adversely affect other businesses and protects existing reward points for consumers.”

Rebuilding Atlantic Canada/Eastern Quebec post Fiona

Establish a provision of $1 billion for 2022-23 for Hurricane Fiona-related requests from provinces under the Disaster Financial Assistance Arrangements.

Skills training

$250 million over five years, starting in 2023-24, to Employment and Social Development Canada to help ensure Canadian workers can thrive in the net zero economy.

Investment tax credit for clean technologies

The government is proposing to create a refundable tax credit equal to 30 per cent of the capital cost of investments in Electricity Generation systems, Stationary Electricity Storage Systems that do not use fossil fuels, Low-Carbon Heat Equipment, and Industrial zero-emission vehicles and related charging or refueling equipment.

The Canada Growth Fund

Will be launched by the end of 2022, initially as a subsidiary of the Canada Development Investment Corporation (CDEV), to begin to make the critical investments needed to meet Canada’s climate and economic goals. The government will take steps to put in place a permanent, independent structure for the Growth Fund, in the first half of 2023.

Transport supply chains

The government will move ahead with many of the recommendation of the National Supply Chain Task Force, including launching a Supply Chains Regulatory Review to improve the efficiency and resiliency of Canada’s supply chains, modernizing cargo and clearance inspection practices, and streamlining operating policies and regulatory practices that impact the flow of goods through international gateways.

Taxation measures

The government intends to introduce a corporate-level 2 per cent tax that would apply on the net value of all types of share buybacks by public corporations in Canada.

Canada responds to the U.S. Inflation Reduction Act (IRA)

The Fall Economic Statement provides Canada’s initial response to the United States’ Inflation Reduction Act (IRA) which became law in August. It authorizes up to US$369 billion dollars over the next decade for “energy security and climate change action.” It expands U.S. support for many different types of clean energy and clean tech, including batteries for EV and stationary power systems, hydrogen production and H2 fuel cell technology, wind, solar, nuclear, biomass, as well as Carbon Capture Utilization and Storage (CCUS). Much of this support comes in the form of Investment Tax Credits (ITC) and Production Tax Credits available only for U.S.-based investment and manufacturing activity – potentially drawing investment and manufacturing away from Canada in this crucial, next-generation, industrial domain. The scale of IRA’s support for clean energy, clean tech and innovation is several orders of magnitude greater than what Canada can match, even on a proportional basis.

Over the past few months, in the face of this increasing American funding, Canada’s federal government has reinforced that an “apples-to-apples” comparison does not fairly illustrate Canada’s advantages, noting that Canada’s carbon pricing regime – becoming $170 per tonne by 2030 – will help maintain investment in major projects in Canada. In the FES today however, the government more directly acknowledged that an investment competitiveness gap with the United States has widened and knows it must level that playing field or face projects drifting south.

Today, Minister Freeland announced the government is proceeding with its commitment, announced in Budget 2022, to establish an investment tax credit to support investments in clean hydrogen production. In addition, the Department of Finance will launch a consultation on how best to implement an investment tax credit for clean hydrogen based on the lifecycle carbon intensity of hydrogen.

Budget Implementation Act (BIA 2)

Every federal budget is traditionally followed by two budget implementation bills (or “BIA”s) – one in the spring and one in the fall. The government hopes to introduce “BIA 2” in the House of Commons on November 4th, to include the second round of outstanding budgetary measures from the spring, plus measures in the Fall Economic Statement that require parliamentary approval.

Analysis

The minister had to triangulate among a series of competing pressures as she confronted what to do in today’s Fall Economic Statement. The result was a series of relatively small measures responding to the larger economic and fiscal context and an overall framing of the statement to provide an underlying rationale for the relatively slim and modest package.

The minister had preconditioned publicly against hard times coming and the FES highlighted the current uncertainty, the likely economic slowdown and the need to plan prudently in the face of that. Its two economic scenarios ran from a gradual slowing of virtually no growth to a shallow recession – belying for the moment those who forecast a hard landing.

Politically, the dominant issue in the country is inflation and its impact on affordability and interest rates. There wasn’t much she could do about the latter, other than repeat her support for the Bank of Canada and its independence, but she needed to nod at anxieties about the mounting cost of living. Once again that led to highly targeted but relatively small measures.

The fiscal situation, driven by inflation and the rise in nominal GDP, had provided ample flexibility for spending without driving the deficit and debt-to-GDP ratios the wrong way. However, financial markets and most economists were clear that government spending had to be restrained, particularly if unfunded – the lesson of the recent UK budget debacle. In the end, increased spending was quite modest with a relatively small revenue-raising offset through a new tax on share buybacks.

The final balance was consistent with the widespread caution against undermining restrictive monetary policy through stimulative fiscal initiatives. However, it is unlikely to meet the political demand for more cost-of-living relief. It seems inescapable that pressure will build as growth slows, inflation is slow to abate, and job loss begins to mount. The fear of a significant slowdown or recession led the minister to husband fiscal firepower in case it is needed later. She had been explicit about that in private. She was now explicit about it publicly in the FES.

The government is also cognizant of pressure to close or fill the perceived gap between the U.S. and Canada opened by the U.S. Inflation Reduction Act (IRA) in relation to climate and clean technology investment and incentives, particularly in the electrification of the automotive sector. Clearly the Government of Canada cannot match the size of the U.S. package and likely needs more time to assess its impact. Hence the FES announcements, which amount to a down payment pending further resolution in Budget 2023. The main instruments in the FES package are new tax credits for specific investments in clean tech and hydrogen, tied in part to positive labour market guarantees. The FES promises another package for clean manufacturing including automotive electrification in Budget 2023.

On the innovation side, there was unfinished business from Budget 2022, including the new $15 billion Canada Growth Fund. It would have been peculiar not to show some progress on the innovation and growth centrepiece of the most recent Budget, but obviously design was complex and inter-departmental discussion cumbersome. The Growth Fund will be a significant player in the response to the U.S. IRA, and will be launched by year’s end as an independent operation with its own management and Board and operating on a concessionary basis. It will spend to de-risk green investments by the private sector, including the expansion of carbon capture, utilization and storage (CCUS) projects. Details of its governance and mandate were laid out in the FES. Its final governance model will be completed by mid-2023 but it will be able to make investments through the Canada Development and Investment Agency (CDEV) by year’s end. That was not true of the $1 billion Innovation and Investment Agency. Details about it are promised in the coming weeks before Budget 2023.

In summary, this was a modest package meant to mark time and husband resources until Budget 2023 when line of sight may be clearer on the course of the economy and growth. It will be greeted reasonably well by markets and likely be seen to be largely irrelevant (or a miss) by those hoping for significant relief on the affordability front. The declining deficit and debt/GDP ratio will earn the minister marks for fiscal progress (whether a function of inflation or not), confirm her public turn towards restraint, and render credible her ability to bring forward more fiscal firepower if and when warranted.

On the political side of things, it is evident that the government has become sensitive to a potential vulnerability over perception of overall economic stewardship – with new and crisper competition coming from the new Conservative leader. This presumably underlies some of the FES’s measures that smack of populist appeal: for example, working to eliminate interest from student loans, and the mailing of physical cheques to lower-income Canadians for the augmented GST rebate.

Finally, on an overall note signalling policy direction, the Finance minister used her speech to reiterate elements of what has been called the “Freeland Doctrine” – her foreign policy blueprint unveiled in a recent speech to the Brookings Institution in Washington. The FES speech again spoke of “friendshoring” and strategically harnessing Canada’s energy and critical minerals capacity not only for our own domestic benefit, but out of a sense of obligation to our allies and like-minded countries in the emerging polarized world of two geopolitical camps. This underscoring in the FES should come as welcome news to many in the energy and mining sectors.