A Plan to Grow Our Economy and Make Life More Affordable

The federal government has tabled its 2022 budget in the House of Commons. Following several years of extraordinary government spending in response to the COVID-19 pandemic, this year’s budget attempts to address concerns about the increased cost of living and affordability issues for Canadians across the country, focusing on targeted investments in housing, innovation, and the green economy. The document also seeks to demonstrate the government’s desire to return to more “normal” levels of spending and address rising debt levels. This includes outlining new measures to increase government revenues.

Managing spending pressures and ensuring growth

In crafting this year’s budget, Deputy Prime Minister and Minister of Finance Chrystia Freeland faced a challenging economic and political environment. The inflation rate in Canada now stands at 5.7 per cent, its highest level in 31 years, and supply chain problems continue to disrupt the economy and raise commodity prices. The Bank of Canada has indicated that it is “prepared to act forcefully” on inflation. Many private sector economists have expressed concern that more federal spending will overstimulate an already overheated economy.

During last fall’s election, the Liberals promised to spend an additional $78 billion between now and 2025-26 on new and improved programs. Some of the spending outlined in the budget document does advance select campaign promises. In addition, Russia’s war against Ukraine added an urgent imperative to respond to new geopolitical realities. This budget is also the first test of the supply and confidence agreement recently negotiated between the Liberals and the New Democrats.

The combination of inflation and sharply increased energy prices has created an unanticipated revenue windfall for the federal government that provided flexibility for the new spending announced. The budget reflects the government’s trade-offs between the big-ticket items – health care, housing, climate change and defence spending – over the five-year planning horizon.

In addition to spending restraint, business leaders and bank economists were looking for growth-friendly policies and action to address Canada’s lagging GDP and productivity gap. It remains to be seen if this budget has met those expectations with its notable innovation and investment initiatives.

The finance minister was also clear in her budget speech that the federal government is now winding down the pandemic-related spending that has contributed to unprecedented deficit levels in recent years. Of note, in an effort to ensure large financial institutions support Canada’s broader recovery, the budget proposes to introduce a so-called ‘Canada Recovery Dividend’ which will require banks and life insurers’ groups to pay a one-time 15 per cent tax on taxable income above $1 billion for the 2021 tax year. This acknowledges the reality that the extraordinary financial support offered by the federal government throughout the pandemic resulted in significant profits and an ability to recover faster for many financial institutions.

By the numbers

In the text of the nearly 300 page budget document, the government unveils $60 billion in new spending over the next five years. That said, thanks to a better than expected economic rebound, net spending is anticipated to be about half of this amount.

The document shows that the federal deficit is projected to sit at $113.8 billion for 2021-22. This is down from the $144.5 billion estimated in last fall’s fiscal and economic update.

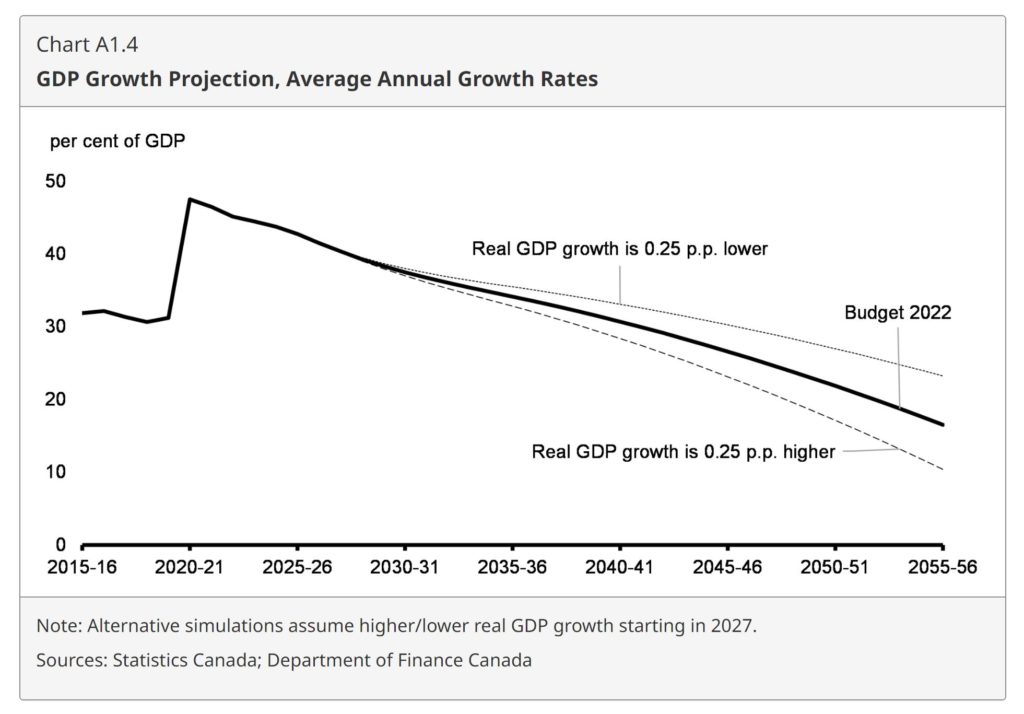

The budget respects the government’s fiscal anchor, keeping the debt-to-GDP ratio on a downward trend.

Analysis

Budget 2022 emphasizes current uncertainties including the Russian invasion of Ukraine, supply chain disruptions, and the threats to global growth from both. It also foresees continuing inflation with the disruptive impacts that will have. Reflecting these uncertainties, Finance Canada tempered its fiscal and economic forecasts with two scenarios, reflecting “heightened” and “moderate” impacts that would serve to weaken both economic and fiscal outcomes.

There is a tension between fiscal policy which is showing substantial new spending in the tens of billions over the next five years with its consequent stimulative impact, and monetary policy, which is heading towards substantial tightening through higher interest rates beginning as soon as next week. There is a similar tension between increased spending by government and the potential inflationary impact of that spending.

It seems clear that both tensions have been exacerbated by the need for an immediate down payment for defence, heading into a review that might well lead to implementing the two per cent of GDP NATO target over time, as well as the decision to launch the dental care plan as part of the Liberal-NDP supply and confidence agreement. The housing package is another spending driver meant to address the housing squeeze and its impact on the cost of living for modest and middle-income Canadians. It is the main response to the politically difficult affordability issue. It is aimed at increasing supply rather than stimulating demand.

A good part of the new spending is directed at consumption rather than growth, although the government insists this is a growth and productivity enhancement agenda. There is a new $15 billion growth fund and a new investment agency to support the government’s growth argument. Both have yet to be outlined. As well, today’s budget tops up the superclusters (now styled as ‘Innovation Clusters’) – a primary innovation vehicle – to provide five more years of funding. Looking ahead though, despite the growth measures announced in the budget, real GDP which has been running well above three per cent, settles back down at two per cent and lower, beginning in 2024.

The government has been able to use the tax revenue windfall (almost $90 billion since the Fall Economic Statement) accrued through the rise in nominal GDP due to inflation and rising energy prices to fund the incremental spending. The government is betting that its fiscal track shows sufficient progress to buttress the minister’s claim to fiscal prudence. It shows a shrinking level of deficits and a declining debt-to-GDP ratio. But of course, both would have shown sharper declines if a larger share of the windfall revenue been directed at the bottom line.

Nevertheless, the deficit falls to a comfortable 1.4% of GDP within two years and only 0.3% of GDP by the end of the five-year horizon. The debt-to-GDP decline is much slower because of COVID-19 pandemic-related debt accumulated over the past two years. Economic projections show the revenue boost from inflation will decline over time, as the CPI drops back down to the mid-two per cent range by 2023.

The complexity of the current rapidly evolving global and domestic economic and geo-political environment has meant that there have been a number of line-item departmental program spending decisions that have been put off for presumably a separate process. It is likely the government has accommodated them in the fiscal framework and will make the individual decisions about them in the coming weeks and months.

Major new initiatives

Housing

Housing is a main focus of the federal budget with approximately $10 billion in spending outlined to address housing affordability issues for Canadians over the next five years. Mirroring several initiatives first outlined in their 2021 election platform document targeting housing supply, the Liberals are moving forward with plans to legislate a ban on foreign ownership of residential properties in Canada for the next two years and implement a new Tax-Free First Home Savings Account to allow first-time home buyers to save up to $40,000.

The housing section of the budget also commits to invest: $4 billion to help municipalities update their zoning and permit systems to support the construction of residential properties through the Housing Accelerator Fund; $1 billion for affordable housing; and $1.5 billion in loans and funding for co-op housing.

As part of the recent supply and confidence agreement with the NDP, the Liberals pledged to advance its platform commitment to launch a Housing Accelerator Fund to boost market-rate supply by incentivising housing construction through red tape reduction at the municipal level. This new fund will target the creation of 100,000 net new housing units over the next five years.

Growth & innovation

Budget 2022 includes several measures to boost lagging Canadian productivity with a focus on an overarching growth agenda. Indeed, in her remarks, Minister Freeland acknowledged that Canada’s productivity and innovation indicators are lagging and are “the Achilles heel of the Canadian economy”.

To help guide progress, the budget indicates the government’s intention to establish a permanent Council of Economic Advisors to help provide policy options and advice on strengthening Canada’s prospects for long-term economic growth. Further details on the make-up of the Council are still to come.

With heavy emphasis on the transition to the green economy, the budget proposes to establish the Canada Growth Fund to attract private international capital and investment to Canada. The fund will operate at arms-length from the federal government and will be initially capitalized at $15 billion over the next five years, with an aim to attract at least $3 of private capital for every $1 invested from public funds.

The federal government is also proposing to create an independent federal innovation and investment agency to work with Canadian industries and businesses to support the scaling of investments in innovation and R&D to make Canada a global leader in this space. More details on the design and mandate of this agency are anticipated in the 2022 fall economic and fiscal update.

While the mandate letter of the minister of innovation, science and industry tasked the minister to establish a “a uniquely Canadian approach modelled on the Defense Advanced Research Projects Agency (DARPA)”, the new investment agency appears to take inspiration from Finland and Israel in seeking to move ideas to market.

On the R&D side of things, the government will also undertake a review of the Scientific Research and Experimental Development (SR&ED) program to ensure that the program is effectively encouraging R&D in Canada.

Defence

As was widely anticipated the government has increased the defence budget, raising it by $7.2 billion over five years to roughly $41 billion annually in 2026-27. This would represent, in 2026-27, an increase of about 22% over the 2021-22 defence expenditure. This, however, falls far short of the 2014 “Wales Declaration” when NATO member countries pledged to spend at least 2 per cent of GDP on defence by 2024. According to NATO’s 2021 annual report, Canada spent $33.6 billion, or 1.36 per cent of GDP on defence, ranking 25th out of 30 NATO members.

The Government’s 2017 “Strong, Secure and Engaged” Defence White paper precipitated a detailed Defence Investment Plan in 2018 which targeted a modest increase in defence spending to 1.5 percent by 2024, then declining. If the Government had the intention of meeting the 2 per cent threshold of GDP spending by the 2024 target date, then, in nominal terms DND would require an annual budget outlay of approximately $54 to $56 billion in 2024, according to the Parliamentary Budget Office.

In advance of the budget release, most observers agreed that a 2 per cent defence budget would be a “bridge too far” for Canada’s dysfunctional procurement system to absorb, and too rich for the government to consider while outlays on social programs and the energy transition clearly remain paramount for cabinet. Moreover, the buying power of even this increased budget is going to be undermined by inflation and may not allow for the acquisition of the full allotment of 88 F-35 aircraft and 15 new Surface Combatant ships for the navy, much less meet the need for augmented pay and benefits to attract new service members for the Canadian Armed Forces. Significant future investments will be needed to recapitalize DND, acquire the equipment the military requires, and make investments in the human capital necessary for a healthy military.

The defence investments outlined in the 2022 federal budget are focused primarily on NORAD modernization, overhauling the culture of the Canadian Forces as well as setting aside funding for additional military aid for Ukraine. There is also $875 million to support the enhancement of Canada’s cyber-security capabilities. Of note, the budget announces a defence policy review to be launched to update the existing defence policy.

Indigenous Reconciliation

Following the federal government’s $40 billion settlement with First Nations, Inuit and Métis groups in January of this year over the systemic underfunding of child welfare services for Indigenous children and their families, Budget 2022 proposes to spend an additional $11 billion over the next six years. This includes $4 billion to support the implementation of Jordan’s Principle with $87.4 million over the next three years to implement Indigenous child welfare laws in coordination with Indigenous communities, provinces and territories.

Budget 2022 also outlines an additional $4 billion over seven years to close the housing gap in Indigenous communities, including $2.4 billion for on-reserve housing. As well, to help meet the commitment to full and effective implementation of the United Nations Declaration on the Rights of the Indigenous Peoples Act, the budget commits $75 million over five years to co-develop an action plan with Indigenous partners.

Healthcare

The centrepiece of the health component of the federal budget was without a doubt the launch of a $5.3 billion over five years dental care plan starting in 2022. Starting with youth and expanding to seniors and individuals with disabilities the programme will be targeted toward income levels below $70,000 annually. Proposed by the NDP and included within both parties’ platforms in the last federal election, the recent Liberal/NDP supply and confidence agreement clearly accelerated both scope and implementation.

Markers continued to be placed on a “Canada Pharmacare Bill” that is to be passed by the end of 2023 after which time, a newly minted Canada Drug Agency would further the development of a national formulary of essential medicines that includes bulk purchasing. With no funds identified in this budget, the scope and cost of this program remains a significant open question in a space fraught with political sensitivities.

The provinces will likely again express their concern over a lack of clear commitment to their five per cent annual increase in Canada Health Transfer payments versus the current three per cent target, although the budget does continue to point toward further funding opportunities, largely tied to federal priority areas including mental health and primary care.

The budget text hints of negotiations to come. “Any conversation between the federal government and the provinces and territories will focus on delivering better health care outcomes for Canadians. To strengthen our public health care, the federal government will remain focused on advancing the priorities of Canadians, including increased access to primary and mental health care; long-term, home, and community care; dental care; and the effective use of high quality data and digital systems.” Given what was not in today’s budget, those discussions will certainly be lively.

Mental and brain health priorities signalled in the Throne Speech and mandate letters were also included in new budgetary health measures. Additional needed investments in stockpile and pandemic preparedness rounded out the government’s health commitments.

Climate change and energy transition investments

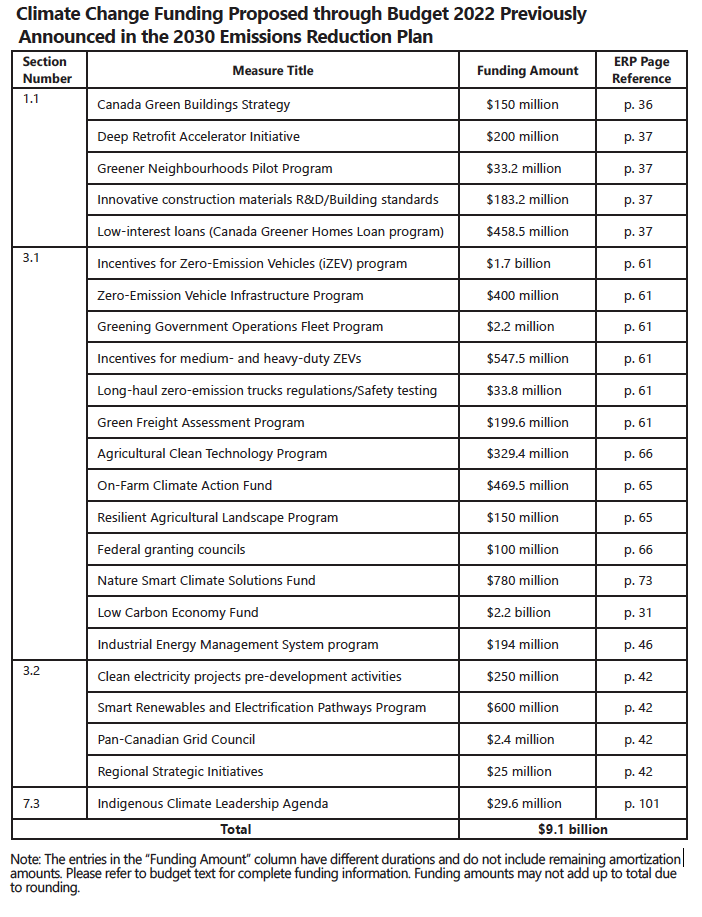

Budget 2022 uses a combination of tax tools, new and existing investment agencies, and targeted sectoral approaches to support the 2030 Emissions Reduction Plan and shift the emissions trajectory of the Canadian economy. In addition to the $100 billion the Liberal government allocated in earlier budgets, this year includes an additional $9.1 billion specifically identified for net-zero electricity investments including for the Atlantic Loop and the Prairie Link, transmission, renewable electricity, grid infrastructure, small modular reactors, hydrogen and battery storage.

Featured prominently is manufacturing and adoption of zero emission passenger vehicles, expected to be adopted broadly by 2035. Transport Canada will continue with a $5,000 incentive program with other departments supporting new charging and refueling infrastructure. Electrifying medium and heavy-duty vehicles also get a nod. A critical minerals strategy acknowledges the link between Canada’s mining opportunities and the development of battery storage technology for our electricity and electric vehicle strategies.

Major new tax credits were introduced around carbon capture, utilization and storage (CCUS,) clean technology deployment, and rebating the carbon pricing to small and medium-sized businesses in key provinces. Agriculture technology and on-farm programs for emissions reductions includes opportunities for farmers in the 2030 strategy.

Leveraging private and public sector investment in the net-zero economy is key to the government’s strategy. Building on existing tools, they extended the Low Carbon Economy Fund and expanded the mandate for the Canada Infrastructure Bank to flow dollars to a more diversified set of clean energy projects. The energy transition is also featured prominently in a $15 billion New Growth Fund and a Canada Innovation and Investment Agency.

There is no question that the government is shifting to a more realistic “all of the above” strategy to the energy transition but the challenge is whether the range of government investments will actually translate into private capital moving into the Canadian economy, supporting growth and jobs, and accelerating a net-zero future.

Though more technical in nature, it is worth noting that the budget moves to phase out flow-through shares for oil, gas and coal; targets net-zero capital flow through pension funds with a Sustainable Finance Action Council; and introduces climate disclosures for all federally regulated institutions that OSFI will oversee.

Emissions reduction plan

On March 29th, Environment and Climate Change Minister Steven Guilbeault tabled the federal government’s 2030 Emissions Reduction Plan under the Canadian Net-Zero Emissions Accountability Act in Parliament, the country’s plan for getting to a net-zero economy by 2050.

Under the 2030 plan, the federal government commits to reducing greenhouse gas emissions (GHG) to 40 per cent lower than 2005 levels, a target that translates to reducing emissions to no more than 443 megatonnes in 2030. In 2019, Canada emitted 730 megatonnes of greenhouse gasses according to the federal government.

From the outside, the 2030 ERP appears comprehensive and credible, the most extensive and detailed national plan yet.

The report outlines five areas that will account for two-thirds of the emissions reductions required to meet the 2030 targets. They are: continued increases in Canada’s pollution pricing regime, a cap on emissions in the oil & gas sector, a Clean Electricity Standard, policies for land-use emissions reductions and a strengthened Clean Fuel Standard (CFS.)

To help industry develop and adopt clean technologies on the path to net-zero by 2050, Canada is positioning for industries to be green and competitive with a variety of technology investment programs and a commitment to help provinces to transition their electrical grids to net-zero power sources such as nuclear small modular reactors (SMR). One new tool will be through CCUS investment tax credits to incentivize the adoption of that technology.

In recent years, the federal government has rolled out a number of funding programs to promote innovation and reduce GHG emissions. The Strategic Innovation Fund (SIF) is the largest to date, providing funding for large projects, with asks of over $10 million under multiple streams of eligibility. Budget 2021 outlined an increase to SIF of $7.2 billion over seven years (ending in fiscal year 2027-28.) Funds for smaller programs were also established, including the $675 million Emissions Reduction Fund to help Canadian oil and gas companies reduce methane emissions. Natural Resources Canada launched the $1.5 billion Clean Fuels Fund in 2021 to support new and existing clean fuel production facilities, including hydrogen, renewable natural gas, and other synthetic and sustainable fuels.

For Canada’s agriculture sector, the $200 million On-Farm Climate Action Fund aims to help farms and producers reduce GHG emissions, store carbon and adopt better practices to manage on-farm emissions. The Agriculture Clean Technology Program also aims to fund the development and adoption of clean technology and promote sustainable growth through direct contributions from Agriculture and Agri-Food Canada. The sector faces an uphill challenge to meet competing needs. Farmers and producers are being asked to decrease emissions and the use of fertilizers and pesticides, while at the same time increasing yields for domestic and international markets. Increased yields of crops such as canola are needed to help feed the growing population in Canada and abroad in light of international unrest and provide feedstocks to support biofuels and a clean fuel standard.

Building for significant emissions reductions over the next eight years to 2030 and then for the two decades our to 2050 requires an integrated approach to ongoing investment programs, policies and legislation to match the ambition of the targets. Ultimately, Canada’s achievements will be judged by actual GHG emissions reductions to Canadians. The next reports on the federal governments progress towards the 2030 emissions targets are scheduled to be released in 2023, 2025 and 2027, as outlined in the Net-Zero Accountability Act. Canada’s progress will also be judged along with the other 196 countries who are party to the Paris Agreement.

Other highlights

- $1.5 billion will go to supporting critical minerals supply chains and the Strategic Innovation fund will receive up to $1 billion to support critical minerals manufacturing, processing and recycling applications.

- Transport Canada will receive $450 million over five years to support supply chain projects and transportation networks.

- The existing Innovation Clusters are re-funded with $750 million of the next five years.

- The government will invest $160 million over five years to protect Canadian research and intellectual property from foreign threats.

- Transport Canada and Infrastructure Canada will receive $400 million to plan and design high speed rail between Toronto and Quebec City.

- An Early Learning and Infrastructure Fund will be funded with $625 million over four years beginning in 2023-24.

- The government will invest $385 million to facilitate entry of a growing number of students, workers and visitors into Canada, and $1.3 billion to support the stability and integrity of Canada’s asylum system.

- To enhance Canada’s cyber-security, the government will invest $875 million over five years.