Ontario’s Plan to Build

This is the final provincial budget under Premier Doug Ford before the 2022 general election in Ontario. This 2022 budget is widely expected to be the foundation of the Ontario PC election platform, with an election scheduled to be called within days for a June 2nd, 2022 vote.

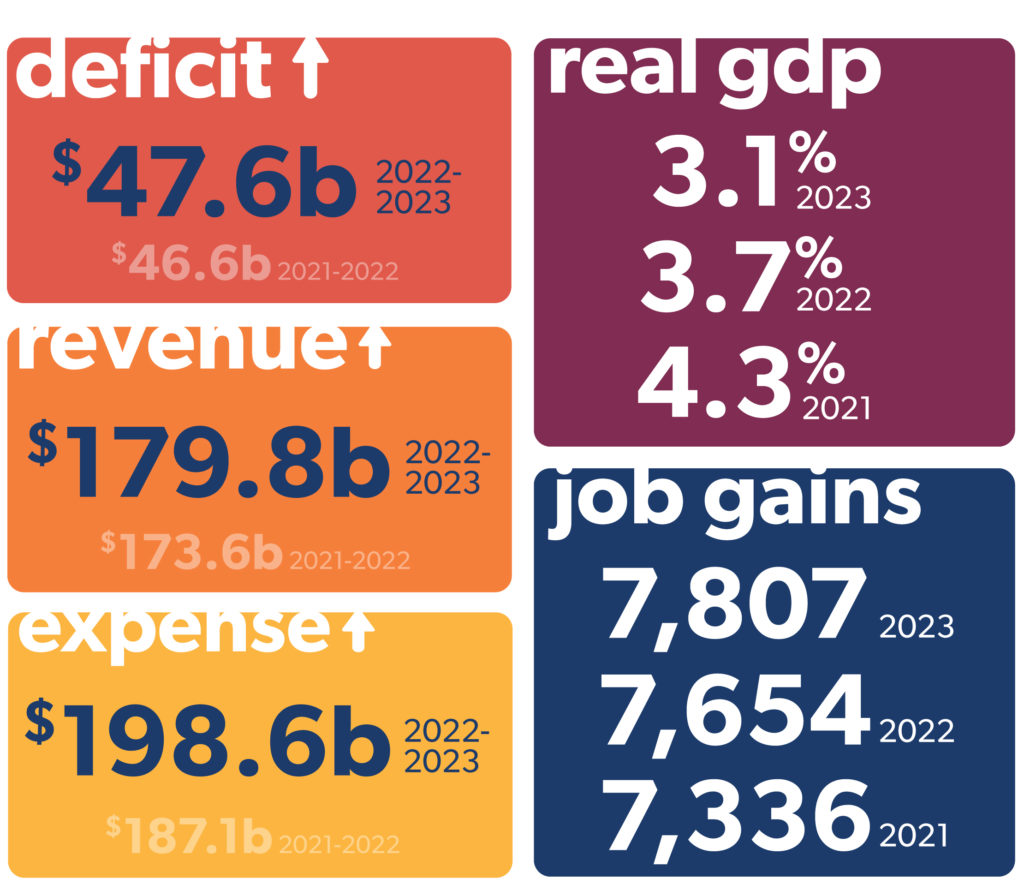

Ontario is now listing its total investment in pandemic response at $38 billion by the end of the 2022-23 fiscal year. That said, while the government is beating its spending and deficit forecasts established in the 2021 budget, overall spending and the deficit is expected to grow, making this the largest spending budget in Ontario’s history. Under the government’s faster growth projections, the budget could be balanced by 2024-25, although the projected range between faster growth and slower growth is a large range of $17 billion, so we need to be cautious about the likelihood of achieving balance in three fiscal years.

The provincial government has a number of important files under its purview – namely Health, Education and Long-Term Care – and this budget is meant to demonstrate continued action to keep Ontarians safe during the pandemic and grow our healthcare system to be prepared for the future. With inflationary pressures abound, this government also addresses the rising cost of living, providing billions in supports to businesses and to households through targeted relief.

With the official opposition NDP already releasing its 2022 Election Platform, and the Ontario Liberals coming to life in recent polls, the unofficial campaign is in full swing.

Key themes

Rebuilding Ontario’s Economy: New good paying manufacturing jobs. More support for small businesses. A mining plan that will finally open up the Ring of Fire.

Working for Workers: Encouraging apprenticeships and opening up jobs in skilled trades. Allowing colleges to grant three-year degrees and increasing the minimum wage.

Building Highways and Key Infrastructure: Finally building the 413 and Brantford bypass. Investing in the 401 East and Hwy 7 expansions and expanding go service in London and Bowmanville.

Keeping Costs Down: Lowering gas taxes getting rid of license plate stickers and removing tolls on the 412 and 418.

A Plan to Stay Open: Hiring more nurses allowing more seniors to stay in their own homes producing more vaccines and PPE right here in Ontario.

By the numbers

Economic indicators and continuing uncertainty

Ontario’s post-COVID economic recovery is projected to continue through 2022, with real growth projected to be 3.7%, moderating to a more typical 2% growth by 2024. Employment growth is also expected to continue to be strong at 3.2% through 2022, moderating to 1.2% by 2025.

Uncertainty, driven by the continuing effects of the pandemic, geopolitical factors and a resurgence of inflation, continues to be a major challenge for all economic forecasters, including Ontario’s. Ontario has chosen a relatively conservative outlook upon which to base its budget but sees potential for a range of possibilities. In its most optimistic scenario, the province could reach fiscal balance as early as 2024-25; in its most pessimistic scenario, Ontario would continue to see a $15B deficit in that same year.

What the fiscal plan suggests

One of the key things to look for in a budget is the overall level of program spending growth. In this budget, the overall level of spending growth over the medium-term averages less than the province’s inflation forecast. As well, the time-limited supports made available over the course of the pandemic are expected to end in 2022-23.

Coupled with the new initiatives the government of Ontario has announced and the spending pressures created in a province with a growing population, this suggests that Ontario will need to reprofile some existing expenditures if it is to remain with this forecast. The degree to which that will need to happen will partly be a function of the continued buoyancy of provincial revenues, as well as any further macroeconomic jolts.

For Ontario businesses and individuals, this creates both risk and opportunity. The Ford government came to power in 2018 believing strongly that there were major efficiencies to be found in the province’s fiscal plan. No doubt, that line of thinking will continue if this government is granted a new mandate. Modernizing programs, ending expenses that are no longer needed and re-drawing the lines of what the private sector provides and what the government provides are all likely to be matters for serious consideration post-election.

Economic growth and recovery

In Budget 2022, the Ontario government has completed the full pivot from pandemic response to economic growth and recovery. The province’s financial documents over the past two years have had to strike a balance between supporting individuals and business impacted by the pandemic, while still continuing to put in place measures to support the longer-term growth and competitiveness of the economy.

In this latest budget, the government is betting that the pandemic is fully in the rear-view mirror and is squarely focused on “Rebuilding Ontario’s Economy” and “Working for Workers” with a series of measures to spur growth and job creation. This includes a focus on key sectors such as, critical minerals, auto and battery manufacturing, and building key infrastructure.

While the Ford Government had taken a previous stance against so-called “corporate welfare,” Budget 2022 solidifies the government’s 180-degree pivot on this, particularly by codifying hundreds of millions of dollars in previously announced investment support to the auto and battery manufacturing sectors to help transition to next generation technologies. To shield against the notion of only picking winners and losers, the government has also highlighted efforts to lower the cost of doing business by $9 billion annually to create a more competitive business environment, with a bulk of these savings helping smaller businesses.

The government has signaled its interest in the venture capital space by rebranding the province’s existing agency to “Venture Ontario” and increasing the Venture Ontario Fund from $100 million to $300 million to further support early-stage companies in key sectors. The pro-worker agenda also continues with a series of measures to encourage further employment in the skill trades, upskilling, and expanding college degree granting to help build a pipeline of job-ready graduates in applied fields.

While nominal GDP growth was a frothy 12%, the government has signalled its awareness that much of this is fuelled by significant inflationary factors that are placing a strain on the pocketbooks of Ontario individuals and families. As such, the budget outlines a number of pocketbook-friendly initiatives to return more funds to taxpayers and reiterates measures to keep the economy open in the face of lingering pandemic concerns. Both of these priorities are aimed ensuring at consumer confidence and supporting continued economic recovery.

Healthcare modernization

The healthcare investments in Budget 2022 focus on expanding Ontario’s healthcare workforce, building increased healthcare capacity, improving hospitals, and patient care while also focusing on some preventative measures like homecare, mental health supports and improving access through the new Health Connect Ontario program aimed at replacing Telehealth Ontario.

The government’s Plan to Stay Open rests on building a better, more resilient healthcare system following the pandemic, commitments to hiring more nurses, allowing more seniors to stay in their own homes longer, and focusing on domestic production of vaccines and other critical supplies.

This budget plans to spend heavily on building more capacity. The government is pledging $40 billion in hospital expansions over 10 years, and is branding this as the largest health plans in Ontario’s history. In addition, Ontario is planning to accelerate building more long-term care homes, with their goal of reaching 30,000 new or repurposed beds in operation by 2026.

Total healthcare expenditures are expected to rise to $75 billion in 2022-23 and are projected to continue rising to $78 billion in fiscal year 2024-25.

Education and child care

The centrepiece of Ontario’s Education and Early Learning program spending focuses on the agreement between the federal government and the Government of Ontario on child care, which is providing $13.2 billion of support from Ottawa. The intent of the program is to give families access to more affordable and high-quality child care options, lower fees for parents, increase spaces, and support the early years workforce.

Education remains the second biggest ministry budget, which is set to increase by $3 billion in 2022-23. Spending is expected to continue to grow to $35 billion by fiscal year 2024-25

In higher education, the Tories are promising another tuition freeze, which is consistent with their themes of affordability and their 10% tuition reduction policies they enacted in their first budget. Given rising costs for higher education institutions and inflationary pressures all around, institutions are expected to feel the financial pinch as students and families enjoy the break. However, importantly on the tuition front, the government is offering a number of targeted grants to encourage students to consider programs in high demand labour markets such as healthcare.

Major initiatives

Winners

The mining industry

Skilled trades

Hospitals

Commuters

Manufacturing

Natural resources + minerals

- Releasing Ontario’s first Critical Minerals Strategy, a five-year plan to strengthen Ontario’s position as a global leader in supplying critical minerals.

Hydrogen + natural gas

- Releasing a Low-Carbon Hydrogen Strategy to support the province’s growing hydrogen sector and launching the Phase 3 consultation of the Natural Gas Expansion Program in Fall 2022.

Hospital expansion

- Investing over $40 billion in capital over 10 years for hospitals and other health infrastructure to support 50 major hospital projects that will add 3,000 new beds over the next decade.

- Investing an additional $3.3 billion in 2022-23 in hospitals supporting the 3,000 acute and post-acute beds and hundreds of new critical care beds that have been added since 2018-19.

- Investing $300M in 2022-23 as part of Ontario’s Surgical Recovery Strategy.

Transit

- $61.6 billion in capital over 10 years for public transit, including expanding GO rail services to London and Bowmanville.

- Increasing PRESTO discounts for postsecondary students and eliminating double fares for local transit with using the GO and creating Transit-Oriented Communities across Ontario that are walking distance to transit lines.

- Building subways, including the Sheppard Subway Extension and the Eglinton Crosstown West Extension.

- Investing $75 million to support passenger rail service in Northeastern Ontario.

Highways

- $21.5 billion in capital over 10 years to support planning, building and improving highways, including Highway 413, the Bradford Bypass, QEW Garden City Skyway, bridge replacements in Oshawa and Port Hope, Highway 401 and Highway 7 between Kitchener and Guelph.

- Investing $492.7M in 2022-23 in targeted infrastructure highway projects in Northern Ontario, as well as funding the reconstruction of Highway 101 through Timmins.

- Removing tolls on Highways 412 & 418.

Long-term care

- Investing more than $60 million over two years for the Paramedicine for Long-Term Care program for all eligible seniors in the province.

Housing

- Supporting and creating all types of housing by investing $3 billion to support community housing and prevent homelessness, while implementing a long-term plan to address the housing crisis through the Housing Affordability Task Force’s recommendations.

- Prioritizing Ontario homebuyers by increasing the Non-Resident Speculation Tax to 20%

- Reducing backlog at the Landlord and Tenant Board as well as the Ontario Land Tribunal by investing $119.2 million.

Social Services

- Fighting insecurity by investing $10 million in 2022-23 by establishing a Food Security and Supply Chain Fund and providing $5.5 million in the Ontario Community Support Program to assist with essential services for low-income seniors and people with Disabilities.

Policing

- $96M over three years to be invested in supporting province-wide responses during unlawful demonstrations that impede international borders/trade.

Education + schools

- Maintaining the current tuition freeze for Ontario’s publicly funded colleges and universities for the 2022-23 academic year.

- An investment of $14 billion in capital grants over 10 years to support modern school infrastructure, with $1.4 billion invested in renewing and maintaining schools for the 2022-23 school year.

- Helping Indigenous workers by investing $9M over three years in the nine Indigenous governed and operated indigenous institutes

Tax reduction

- Cutting the gasoline tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months starting July 1, 2022.

- $300 in additional tax relief in 2022, on average for 1.1 million low-income workers through proposed Low-income Individuals and Families Tax (LIFT) Credit enhancement.

Jobs + economy

- $15.50 hourly general minimum wage, starting October 1, 2022.

- Investments in bringing jobs to provincial agencies through the Community Jobs Initiative, expanding film and television production, investing in Ontario wide high-speed internet, extending the temporary enhancement to the Regional Opportunities Investment Tax Credit and investing $25 million over three years in the Indigenous Economic Development Fund to support Indigenous owned businesses.

- Increasing Venture. Ontario’s capital funding to $300 million and investing $23.9 million to modernize Ontario’s vehicle registration process through the Digital Dealership Registration program.

- Investing an additional $5 million in 2022-23 to support the launch and expansion of the Better Jobs Ontario program.

- Providing $6.9 million over three years to enhance the Investing in Women’s Futures program.

- Investing $15.1 million in the Ontario Immigrant Nominee Program that will help permanent residents find jobs that match the province’s market needs.

- Seeking support from the federal government to renew and enhance the Canada-Ontario Labour Market Transfer Agreement.

Small business

- Creating an Entrepreneurship Council to support the development of Entrepreneurship Strategy and investing nearly $107 million over the next three years in new critical technology initiatives.

Child care

- Working with the federal government to introduce a new Early Learning and Childcare program with $13.2 billion in federal investments to be secured by 2026-27.

Jobs training

- Investing $12 million to extend the Ontario Junior Exploration Program for two years and $4 million per year for the next three years to create a new Critical Minerals Stream

- $1 billion annually in employment and training programs with an additional $114.4 million over three years for the Skilled Trades Strategy and a new three-year applied degree and four-year degree programs to be offered Ontario colleges.

- Providing an additional $15.8 million in 2022-23 to the Skills Development Fund and an additional $268.5 million over the next three years to Employment Ontario.

- $42.5 million over two years to support expansion of medical education and training.

- Investing $124 million in modernized clinical education for nursed at publicly assisted colleges and universities, while investing $142 million to recruit and retain healthcare workers in underserved communities, with $61 million going toward launching the Learn and Stay Grant, and $42.5 million over two tears to support undergraduate and postgraduate medical education in Brampton and Scarborough.

Infrastructure

- Close to $1 billion for critical legacy infrastructure, such as all-season roads to the Ring of Fire to build the corridor to prosperity and seize Ontario’s critical mineral opportunities.

- $158.8 billion Capital Plan over 10 years, including $20 billion in 2022-23: one of the most ambitious capital plans in Ontario’s history.

- Investing nearly $2 billion over five years in the Ontario. Community Infrastructure Fund, which will help 424 small, rural and Northern communities build critical infrastructure.

- Investing $10.2 billion in the Investing in Canada Infrastructure Program and $24 million over three years for the planning and construction of the Holland Marsh Phosphorus Recycling Facility that will protect Ontario’s water.

Manufacturing

- More than $12 billion attracted in new investment for new vehicle production mandates and battery manufacturing over the past 18 months, to help create good manufacturing jobs.

Motor vehicles

- $120/year savings in Southern Ontario and $60 year/ savings in Northern Ontario by eliminating license plate renewal fees for passenger and light commercial vehicles.

- Reducing auto insurance rates by adding additional measures that will create choice, reduce insurance fraud, and enhance fairness.

Seniors

- Proposing a new, refundable Ontario Seniors Care at Home Tax Credit.

Home care

- Planning to invest $1 billion over the next three years to improve quality of care and support recruitment and training.

Mental health care

- Providing an additional $5 million per year for three years to support 6,500 individual a year with dementia care and services as well as an additional $204 million for mental health and addition services.

Accessibility

- Providing an additional $15 million over three years to support and expand the Home and Vehicle Modification Program that will help 1,200+ individuals make their homes more accessible.

Domestic production + investments

- Ensuring that Ontario has a stockpile of personal protective equipment and critical supplies being produced in Ontario while investing $15 million over three years in a new Life Sciences Innovation program.

- Attracting $12 billion in investments for the auto sector, specifically hybrid and electrical vehicle production and batteries and providing $91 million to make electrical vehicle chargers more accessible.

Ontario’s front-line workers

- Investing $764 million over two years to provide Ontario nurses with up to a $5,000 retention bonus and $2.8 billion over the next three years to make the current PSW/DSW wage enhancement permanent.

- Investing $230 million in 2022-23 to enhance healthcare capacity in hospitals and $49 million over year threes to train and recruit new critical care works.

- Investing $42.2 million over three years for programs that provide access to specialized mental health services for public safety personnel and $56.8 million in 2022-23 to support first responders across Ontario.

- Supporting the Dedicated Offload Nursing program by investing $7 million in 2022-23 and investing an additional $2 million over two years for the Emergency Volunteer program.

What does this mean for Ford’s re-election

With this budget, the Ontario PC government continues to frame its agenda under the umbrella of “Building Ontario,” covering pillars such as large-scale infrastructure projects, housing, and economic opportunity. With a diminished focus on pandemic response and fiscal conservatism, they are betting that Ontario voters are more concerned about their economic prospects, lowering their cost of living, and cutting daily commutes. In that sense, the document accomplishes this political communications exercise and voters will get an almost immediate say on the proposed direction.

The upcoming Ontario election is set for June 2nd, 2022. It will feature an incumbent Ford government running for re-election on the record of its first mandate. While all budgets are inherently political communication documents, this takes on greater relevancy with Ontario’s 2022 Budget given it also serves as the Ontario PCs policy platform for the impending election.

Overall, the budget serves the Ontario PCs re-election efforts well by appealing to suburban voters in the Greater Toronto Area (also known as FordNation), targeting potential swing seats in Northern and Southwestern Ontario, and framing the election wedge issues primarily on their terms.

What does this mean for the Opposition NDP

The Ontario NDP have framed Ford’s budget as the latest example of a government that doesn’t follow through on campaign promises and funding commitments, especially given the Ford government has not committed to re-tabling this budget should the PC’s get re-elected. The ONDP have said that recent analysis shows the Ford government has only kept 37 per cent of their 2018 election promises and is warning of a looming ‘bait and switch’, accusing the government of having a secret budget that will include severe cuts affecting the most vulnerable people in Ontario.

As the budget represents the de-facto kickoff of the 2022 campaign, and campaigns are about getting the electorate to agree on your preferred ballot question, the Ontario NDP’s strategy is to stay out of the weeds on specific commitments, unless they see a gap in the budget that reinforces one of their core campaign themes of “They broke it, we’ll fix it” “cuts” and the Ford government favouring their “buddies” over the little guy in an attempt to drive a message that change is needed, and only the ONDP is the electoral vehicle for that change.

What does this mean for the Ontario Liberals

The budget document will not hold a lot of surprises for the Ontario Liberals and will not alter their strategy of campaigning to bring real leadership back to Ontario. While they will be complimentary to certain initiatives, they will emphasize that the new budget is a highly political document that is not based in thoughtful consideration on what is needed to support Ontarians, nor to drive the Ontario economy. They will also be quick to point out that it will not ease the anxiety being felt by many Ontarians because of the cost-of-living increases and challenges resulting from the pandemic.

Similar to the NDP strategy, don’t expect the Liberals to get into the weeds on specifics but to stick to high level campaign themes. On the other hand, expect the Del Duca Ontario Liberals to forcefully identify the issues that are absent from the new fiscal plan – most notably the environment – and in areas where it is perceived that the PCs have been influenced by groups friendly to Ford.